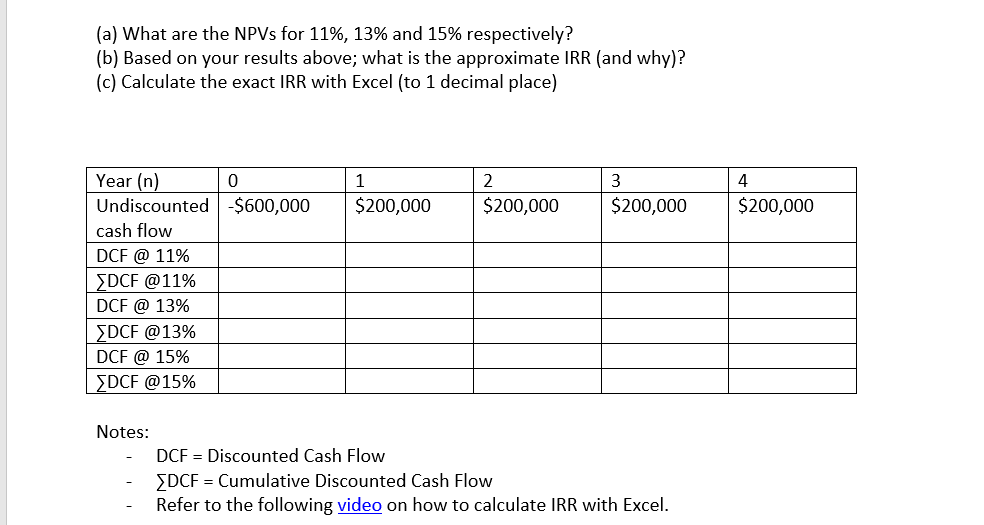

Question: 3.2 Discounted Cash Flow We could have continued by using the Net Cash Flow from Question 3.1, but any mistakes in would then affect Question

3.2 Discounted Cash Flow

We could have continued by using the Net Cash Flow from Question 3.1, but any mistakes in would then affect Question 3.2 Hence we will define a new (simplified) project.

For the project below, please answer the following questions

CASH FLOW

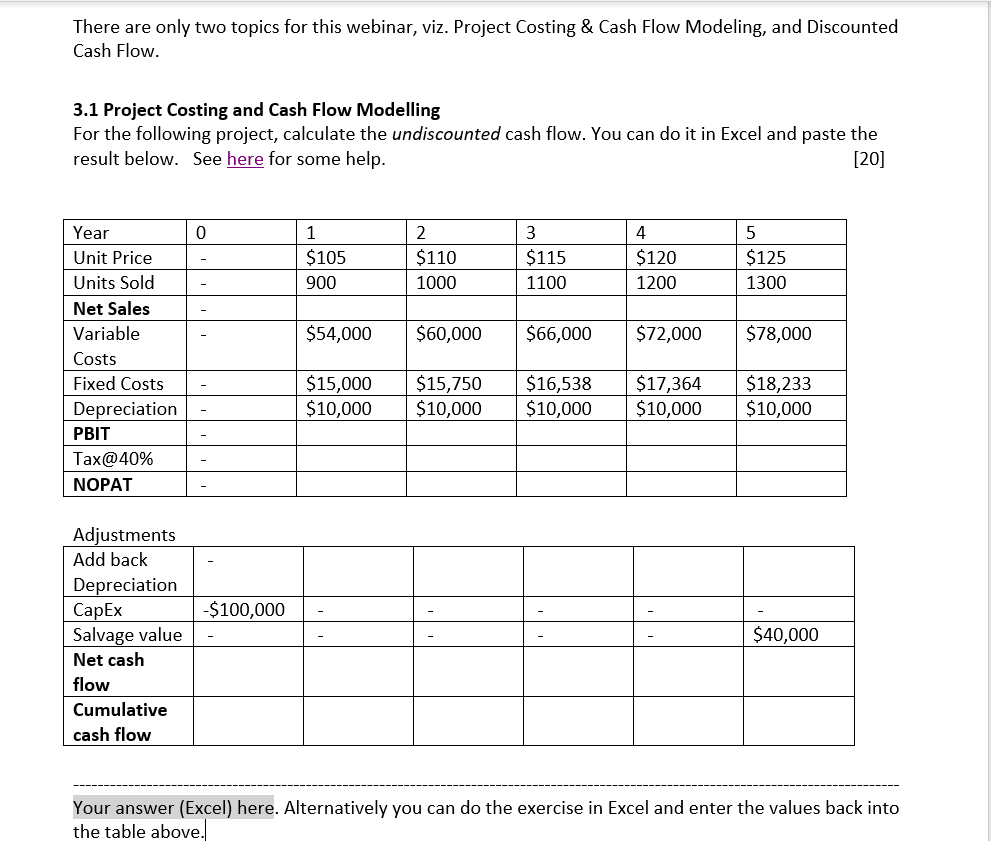

Net Sales = Turnover = Gross Income = Price per unit times number of units sold

PBIT = Profit Before Interest and Tax = Net Sales minus Costs (fixed and Variable) minus depreciation. Note that we are treating depreciation as if it were an expense. What we are doing is hiding part of our profits with the blessing with the Tax Office. The depreciation allowance is not really gone...we just make sure it doesnt get taxed. In our example we do not have any interest payments.

NOPAT = Net Operating Profit After Tax = PBIT minus Tax. This is known as the Bottom Line as it is the last entry on the Income Statement (Profit & Loss Account).

Adjustments

- For years 1 thru 5 we have to add back the hidden depreciation allowance because it represents real cash.

- For Year 0 (i.e. the beginning of year 1) we have to deduct the Capital Expenditure (note the negative sign because it is a cash outflow.)

- For Year 5 we have to add the salvage value of the plant (note the positive sign as it is a cash inflow).

- The Net Cash Flow for each column is now simply the NOPAT plus the adjustments for that period.

- The Cumulative Cash flow is easy to calculate. For period 0 it is equal to the Net Cash Flow for period 0. For period 1 it is = the cumulative Cash Flow for period 0 plus the Net Cash Flow for period 1. For period 2 it is = the cumulative Cash Flow for period 1 plus the Net Cash Flow for period 2. And so on.

There are only two topics for this webinar, viz. Project Costing & Cash Flow Modeling, and Discounted Cash Flow. 3.1 Project Costing and Cash Flow Modelling For the following project, calculate the undiscounted cash flow. You can do it in Excel and paste the result below. See here for some help. [20] 0 1 $105 900 2 $110 1000 3 $115 1100 4 $120 1200 5 $125 1300 $54,000 $60,000 $66,000 $72,000 $78,000 Year Unit Price Units Sold Net Sales Variable Costs Fixed Costs Depreciation PBIT Tax@40% NOPAT $15,000 $10,000 $15,750 $10,000 $16,538 $10,000 $17,364 $10,000 $18,233 $10,000 $100,000 Adjustments Add back Depreciation CapEx Salvage value Net cash flow Cumulative cash flow $40,000 Your answer (Excel) here. Alternatively you can do the exercise in Excel and enter the values back into the table above. (a) What are the NPVs for 11%, 13% and 15% respectively? (b) Based on your results above; what is the approximate IRR (and why)? (c) Calculate the exact IRR with Excel (to 1 decimal place) 2 $200,000 3 $200,000 4 $200,000 $200,000 Year (n) 0 Undiscounted $600,000 cash flow DCF @ 11% EDCF @11% DCF @ 13% DCF @13% DCF @ 15% EDCF @15% Notes: DCF = Discounted Cash Flow {DCF = Cumulative Discounted Cash Flow Refer to the following video on how to calculate IRR with Excel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts