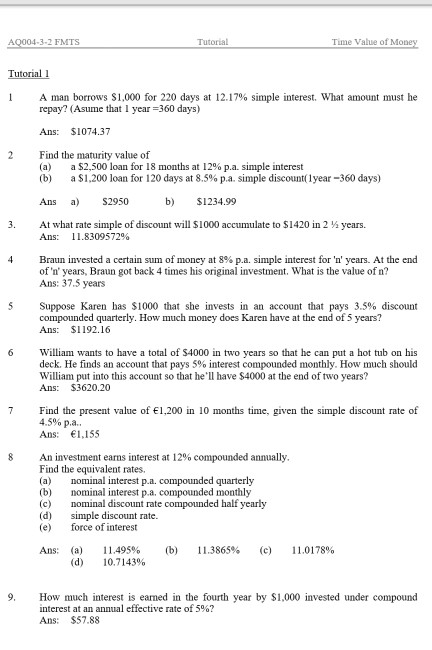

Question: 3-2 FMTS Tutorial Time Value of Mo Tutorial 1 A man borrows $1,000 for 220 days at 12.17% simple interest. What amount must he repay?

3-2 FMTS Tutorial Time Value of Mo Tutorial 1 A man borrows $1,000 for 220 days at 12.17% simple interest. What amount must he repay? (Asume that 1 year -360 days) As $1074.37 2 Find the maturity value of (a) (b) a $2,500 loan for 18 months at 12% p.a. simple Interest a $1,200 loan for 120 days at 8.5% p.a. simple discount( 1 year-360 days) Ans S2950 b) $1234.99 At what rate simple of discount will $1000 accumulate to $1420 in 2 years. Ans: 11.8309572% Braun invested a certain sum of money at 8% p.a. simple interest for 'n' years. At the end of'n' years, Braun got back 4 times his original investment. What is the value of n? Ans: 37.5 years 5 Suppose Karen has $1000 that she invests in an account that pays 3.5% discount compounded quarterly. How much money does Karen have at the end of 5 years? Ans: S1192.16 6 illiam wants to have a total of $4000 in two years so that he can put a hot tub on his deck. He finds an account that pays 5% interest compounded monthly. How much should William put into this account so that he'll have $4000 at the end of two years? Ans: $3620.20 7 Find the present value of 1,200 in 10 months time, given the simple discount rate of 4.500 p.a. . Ans: 1,155 An investment earns interest at 12% compounded annually Find the equivalent rates. (a minal interest p.a. compounded quarterly (b) nominal interest p.a. compounded monthly (c) nominal discount rate compounded half yearly (d) simple discount rate. (e force of interest Ans: (a) (d) 11.495% 10.7143% (b) 11.3865% (c) 11.0178% 9.How much interest is eaned in the fourth year by $1,000 invested under compound interest at an annual effective rate of 5%? Ans: $57.88

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts