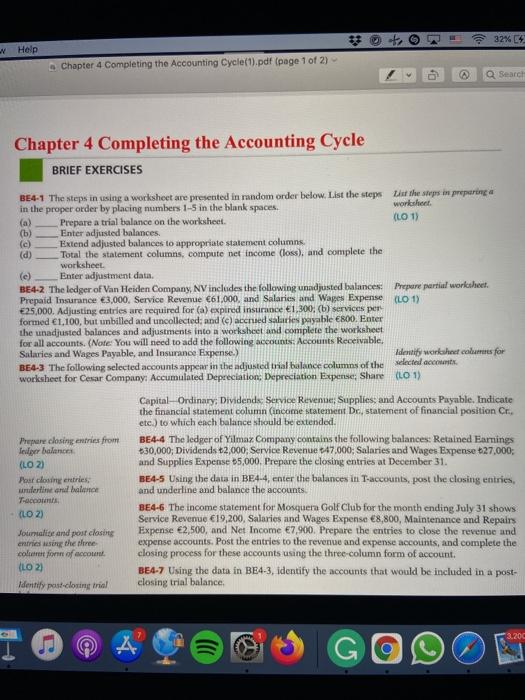

Question: ** 32% % - Help Chapter 4 Completing the Accounting Cycle(1).pdf (page 1 of 2) Q Search Chapter 4 Completing the Accounting Cycle BRIEF EXERCISES

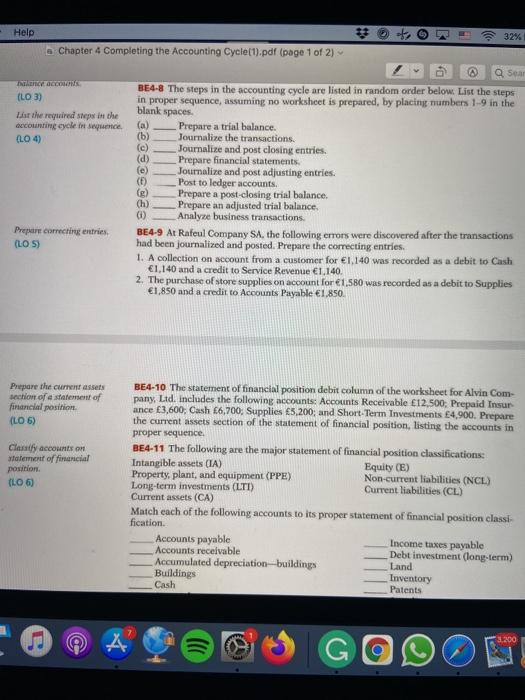

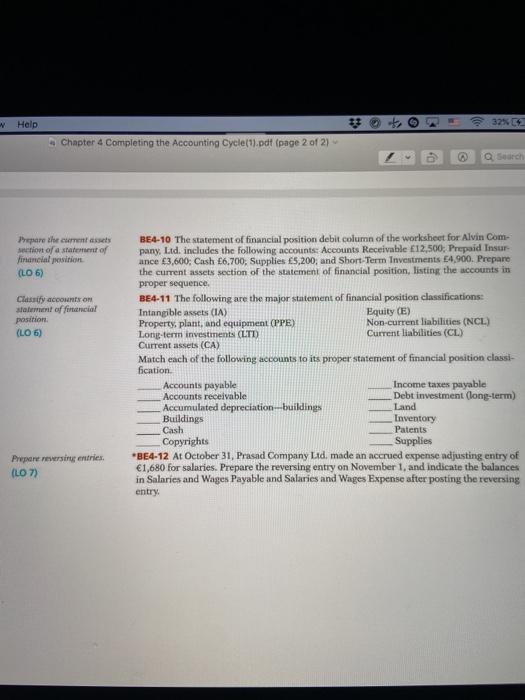

** 32% % - Help Chapter 4 Completing the Accounting Cycle(1).pdf (page 1 of 2) Q Search Chapter 4 Completing the Accounting Cycle BRIEF EXERCISES BE4-1 The steps in using a worksheet are presented in random order below. List the steps in the steps in preparing in the proper order by placing numbers 1-5 in the blank spaces. worksheet (a) Prepare a trial balance on the worksheet (LO 13 (b) Enter adjusted balances. (c) Extend adjusted balances to appropriate statement columns (d) Total the statement columns, compute net income (loss), and complete the worksheet (e) Enter adjustment data BE4-2 The ledger of Van Heiden Company, NV includes the following unadjusted balances Prepare partial worksheet Prepaid Insurance 3,000. Service Revenue 61,000, and Salaries and Wages Expense (LO 1) 25,000. Adjusting entries are required for (a) expired insurance 1,300. (b) services per formed 1,100, but unbilled and uncollected; and (c) accrued salaires payable 800, Enter the unadjusted balances and adjustments into a worksheet and complete the worksheet for all accounts. (Note: You will need to add the following accounts, Accounts Receivable, Salaries and Wages Payable, and Insurance Expense.) Identity worksheet bare for BE4-3 The following selected accounts appear in the adjusted trial balance columns of the selected at worksheet for Cesar Company: Accumulated Depreciation, Depreciation Expense; Share (LO 1) Capital Ordinary: Dividende Service Revenue; Supplies, and Accounts Payable, Indicate the financial statement column (income statement De, statement of financial position Cr.. etc.) to which each balance should be extended. Prepare closing entries from BE4-4 The ledger of Yilmaz Company contains the following balances: Retained Earnings Ieder balance +30,000; Dividends +2,000; Service Revenue 247.000: Salaries and Wages Expense 27.000 (LO2) and Supplies Expense 15.000. Prepare the closing entries at December 31. Por closing cetries BE4-5 Using the data in BE4.4, enter the balances in Taccounts, post the closing entries. under and bac and underline and balance the accounts. , (LO2) BE4-6 The income statement for Mosquera Golf Club for the month ending July 31 shows Service Revenue 19,200, Salaries and Wages Expense 8,800, Maintenance and Repairs Journal and post closing Expense 2,500, and Net Income 7.900. Prepare the entries to close the revenue and entre song the three expense accounts. Post the entries to the revenue and expense accounts, and complete the coleret for of account closing process for these accounts using the three-column form of account, (LO) BE4-7 Using the data in BE4-3, identify the accounts that would be included in a post- Identify post-closing trial closing trial balance, 3.200 (od GOS + 12 blank spaces Help 32% Chapter 4 Completing the Accounting Cycle(1).pdf (page 1 of 2) QS INCON BE4-8 The steps in the accounting cycle are listed in random order below. List the steps (LO 3) in proper sequence, assuming no worksheet is prepared, by placing numbers 1-9 in the Las the required steps in the accounting cycle in (a) Prepare a trial balance. 004) (b) Journalize the transactions. (e) Journalize and post closing entries. (d) Prepare financial statements. (e) Journalize and post adjusting entries. (5) Post to ledger accounts. (g Prepare a post-closing trial balance ch) Prepare an adjusted trial balance. 0 Analyze business transactions Prepare correcting entries BE4-9 At Rafeul Company SA, the following errors were discovered after the transactions (LOS) had been journalized and posted. Prepare the correcting entries 1. A collection on account from a customer for 1,140 was recorded as a debit to Cash 1,140 and a credit to Service Revenue 1,140 2. The purchase of store supplies on account for 1,500 was recorded as a debit to Supplies 1.850 and a credit to Accounts Payable 1.850 Prepare the current assets section of a statement of financial position (LO 6) Classify accounts on alement of financial position (LO 6) BE4-10 The statement of financial position debit column of the worksheet for Alvin Com- pany, Ltd. includes the following accounts: Accounts Receivable 12,500; Prepaid Insur ance 3,600: Cash 66,700, Supplies 5,200; and Short-Term Investments 4,900. Prepare the current assets section of the statement of financial position, listing the accounts in proper sequence BE4-11 The following are the major statement of financial position classifications: Intangible assets (IA) Equity (E) Property, plant, and equipment (PPE) Non-current liabilities (NCL) Long-term investments (LTI) Current liabilities (CL) Current assets (CA) Match each of the following accounts to its proper statement of financial position classi- fication. Accounts payable Income taxes payable Accounts receivable Debt investment (long-term) Accumulated depreciation-buildings Land Buildings Inventory Cash Patents )) 1.200 G # Help 32% Chapter 4 Completing the Accounting Cycle(1).pdf (page 2 of 2) Prepare the current asses section of a statement of financial position (LO 6) Classify accounts on statement of financial position (LO 6) BE4-10 The statement of financial position debit column of the worksheet for Alvin Com- pany Ltd. includes the following accounts: Accounts Receivable 12,500; Prepaid Insur ance 3,600; Cash 6,700, Supplies 5,200, and Short-Term Investments 4,900. Prepare the current assets section of the statement of financial position, listing the accounts in proper sequence, BE4-11 The following are the major statement of financial position classifications: Intangible assets (IA) Equity (E) Property, plant, and equipment (PPE) Non-current liabilities (NCL) Long-term investments (LTL Current liabilities (CL) Current assets (CA) Match each of the following accounts to its proper statement of financial position classi- fication Accounts payable Income taxes payable Accounts receivable Debt investment (long-term) Accumulated depreciation-buildings Land Buildings Inventory Cash Patents Copyrights Supplies BE4-12 At October 31, Prasad Company Ltd. made an accrued expense adjusting entry of 1,680 for salaries. Prepare the reversing entry on November 1, and indicate the balances in Salaries and Wages Payable and Salaries and Wages Expense after posting the reversing entry Prepareerinu entries (LO 7)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts