Question: 32. How are BBB and AAA bonds similar or different? a. AAA bonds are high yield and BBB bonds are investment grade. b. Both are

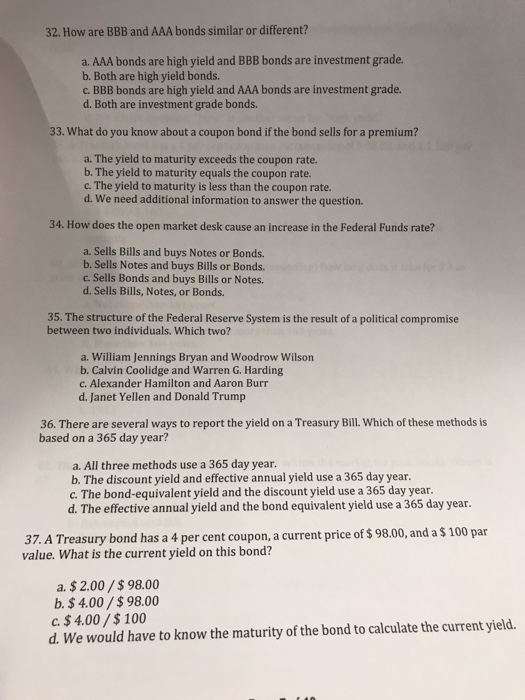

32. How are BBB and AAA bonds similar or different? a. AAA bonds are high yield and BBB bonds are investment grade. b. Both are high yield bonds. c. BBB bonds are high yield and AAA bonds are investment grade. d. Both are investment grade bonds 33. What do you know about a coupon bond if the bond sells for a premium? a. The yield to maturity exceeds the coupon rate. b. The yield to maturity equals the coupon rate. c. The yield to maturity is less than the coupon rate d. We need additional information to answer the question. 34. How does the open market desk cause an increase in the Federal Funds rate? a. Sells Bills and buys Notes or Bonds. b. Sells Notes and buys Bills or Bonds. c. Sells Bonds and buys Bills or Notes. d. Sells Bills, Notes, or Bonds. 35. The structure of the Federal Reserve System is the result of a political compromise between two individuals. Which two? a. William Jennings Bryan and Woodrow Wilson b. Calvin Coolidge and Warren G. Harding c. Alexander Hamilton and Aaron Burr d. Janet Yellen and Donald Trump 36. There are several ways to report the yield on a Treasury Bill. Which of these methods is based on a 365 day year? a. All three methods use a 365 day year. b. The discount yield and effective annual yield use a 365 day year. c. The bond-equivalent yield and the discount yield use a 365 day year. d. The effective annual yield and the bond equivalent yield use a 365 day year. 37. A Treasury bond has a 4 per cent coupon, a current price of $ 98.00, and a value. What is the current yield on this bond? $ 100 par a. $2.00/$98.00 b.$4.00/$98.00 c.$ 4.00/$ 100 d. We would have to know the maturity of the bond to calculate the current yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts