Question: 3.2. Risk Analysis and Project evaluation: NPV break-even analysis (8 marks) Assume that for Project 2, the company finally chose Option B. It expects to

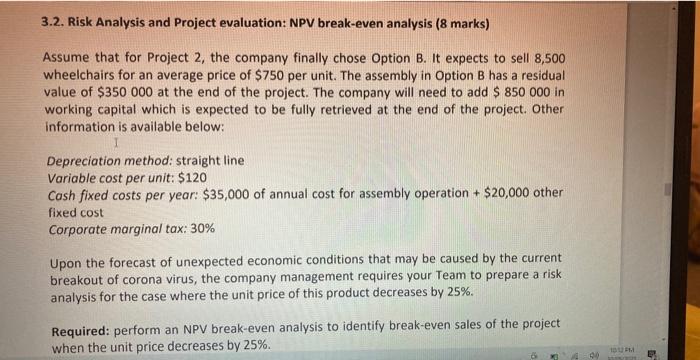

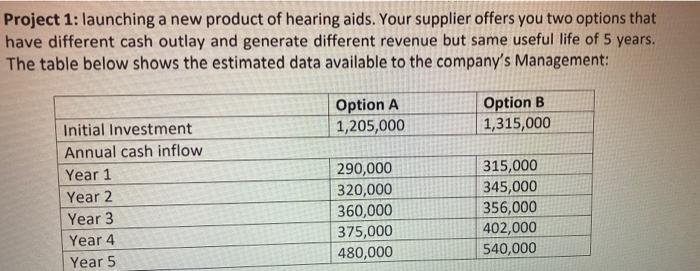

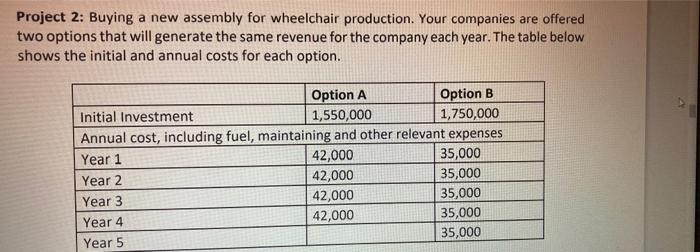

3.2. Risk Analysis and Project evaluation: NPV break-even analysis (8 marks) Assume that for Project 2, the company finally chose Option B. It expects to sell 8,500 wheelchairs for an average price of $750 per unit. The assembly in Option B has a residual value of $350 000 at the end of the project. The company will need to add $ 850 000 in working capital which is expected to be fully retrieved at the end of the project. Other information is available below: Depreciation method: straight line Variable cost per unit: $120 Cash fixed costs per year: $35,000 of annual cost for assembly operation + $ 20,000 other fixed cost Corporate marginal tax: 30% Upon the forecast of unexpected economic conditions that may be caused by the current breakout of corona virus, the company management requires your Team to prepare a risk analysis for the case where the unit price of this product decreases by 25%. Required: perform an NPV break-even analysis to identify break-even sales of the project when the unit price decreases by 25%. 10 Upon the forecast of unexpected economic conditions that may be caused by the current breakout of corona virus, the company management requires your Team to prepare a risk analysis for the case where the unit price of this product decreases by 25%. Required: perform an NPV break-even analysis to identify break-even sales of the project when the unit price decreases by 25%. Conclusion Summarize / Reflection the outcomes of your group's works (not more than 150 words) Assignment Preparation guideline/ Important Note: Students are required to attend Interactive Tutorial Session Week 8 (topic 6) and Week 9 (Topic 7) for inputs to answer the questions in Part 1 and 2, and training on how to work with correct capital budgeting technique, proper format, structure, calculation tables and terminologies. Assignments with different templates, terminologies and calculations from the solution templates and guidance provided to you in the sessions will be investigated as potential contract cheater done assignments. Project 1: launching a new product of hearing aids. Your supplier offers you two options that have different cash outlay and generate different revenue but same useful life of 5 years. The table below shows the estimated data available to the company's Management: Option A 1,205,000 Option B 1,315,000 Initial Investment Annual cash inflow Year 1 Year 2 Year 3 Year 4 Year 5 290,000 320,000 360,000 375,000 480,000 315,000 345,000 356,000 402,000 540,000 Project 2: Buying a new assembly for wheelchair production. Your companies are offered two options that will generate the same revenue for the company each year. The table below shows the initial and annual costs for each option. Option A Option B Initial Investment 1,550,000 1,750,000 Annual cost, including fuel, maintaining and other relevant expenses Year 1 42,000 35,000 Year 2 42,000 35,000 Year 3 42,000 35,000 Year 4 42,000 35,000 Year 5 35,000 3.2. Risk Analysis and Project evaluation: NPV break-even analysis (8 marks) Assume that for Project 2, the company finally chose Option B. It expects to sell 8,500 wheelchairs for an average price of $750 per unit. The assembly in Option B has a residual value of $350 000 at the end of the project. The company will need to add $ 850 000 in working capital which is expected to be fully retrieved at the end of the project. Other information is available below: Depreciation method: straight line Variable cost per unit: $120 Cash fixed costs per year: $35,000 of annual cost for assembly operation + $ 20,000 other fixed cost Corporate marginal tax: 30% Upon the forecast of unexpected economic conditions that may be caused by the current breakout of corona virus, the company management requires your Team to prepare a risk analysis for the case where the unit price of this product decreases by 25%. Required: perform an NPV break-even analysis to identify break-even sales of the project when the unit price decreases by 25%. 10 Upon the forecast of unexpected economic conditions that may be caused by the current breakout of corona virus, the company management requires your Team to prepare a risk analysis for the case where the unit price of this product decreases by 25%. Required: perform an NPV break-even analysis to identify break-even sales of the project when the unit price decreases by 25%. Conclusion Summarize / Reflection the outcomes of your group's works (not more than 150 words) Assignment Preparation guideline/ Important Note: Students are required to attend Interactive Tutorial Session Week 8 (topic 6) and Week 9 (Topic 7) for inputs to answer the questions in Part 1 and 2, and training on how to work with correct capital budgeting technique, proper format, structure, calculation tables and terminologies. Assignments with different templates, terminologies and calculations from the solution templates and guidance provided to you in the sessions will be investigated as potential contract cheater done assignments. Project 1: launching a new product of hearing aids. Your supplier offers you two options that have different cash outlay and generate different revenue but same useful life of 5 years. The table below shows the estimated data available to the company's Management: Option A 1,205,000 Option B 1,315,000 Initial Investment Annual cash inflow Year 1 Year 2 Year 3 Year 4 Year 5 290,000 320,000 360,000 375,000 480,000 315,000 345,000 356,000 402,000 540,000 Project 2: Buying a new assembly for wheelchair production. Your companies are offered two options that will generate the same revenue for the company each year. The table below shows the initial and annual costs for each option. Option A Option B Initial Investment 1,550,000 1,750,000 Annual cost, including fuel, maintaining and other relevant expenses Year 1 42,000 35,000 Year 2 42,000 35,000 Year 3 42,000 35,000 Year 4 42,000 35,000 Year 5 35,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts