Question: 32) When using the allowance method, the write-off of a receivable A) involves a contra-revenue account B) reduces the amount of the Allowance for Bad

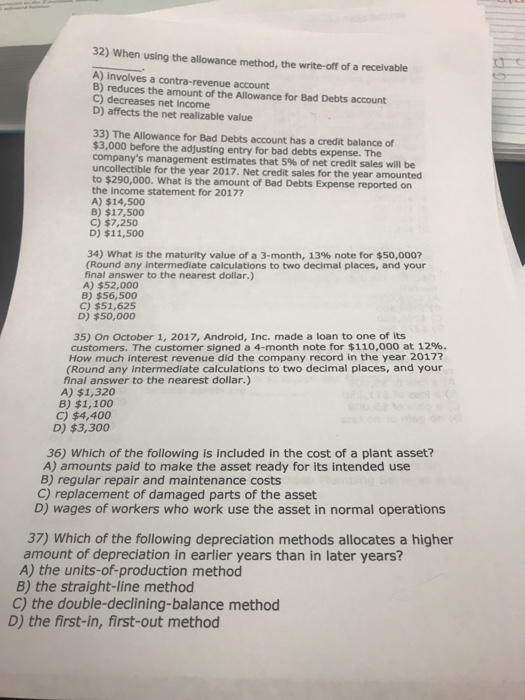

32) When using the allowance method, the write-off of a receivable A) involves a contra-revenue account B) reduces the amount of the Allowance for Bad Debts account C) decreases net income D) affects the net realizable value 33) The Allowance for Bad Debts account has a credit balance of $3,000 before the adjusting entry for bad debts expense. The company's management estimates that 5% of net credit sales will be uncollectible for the year 2017. Net credit sales for the year amounted to $290,000. What is the amount of Bad Debts Expense reported on the income statement for 2017? A) $14,500 B) $17,500 C) $7,250 D) $11,500 34) What is the maturity value of a 3-month, 13% note for $50,000? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.) A) $52,000 B) $56,500 C) $51,625 D) $50,000 35) On October 1, 2017, Android, Inc. made a loan to one of its customers. The customer signed a 4-month note for $110,000 at 12%. How much interest revenue did the company record in the year 2017? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.) A) $1,320 B) $1,100 C) $4,400 D) $3,300 36) Which of the following is included in the cost of a plant asset? A) amounts paid to make the asset ready for its intended u B) regular repair and maintenance costs C) replacement of damaged parts of the asset D) wages of workers who work use the asset in normal operations 37) Which of the following depreciation methods allocates a higher amount of depreciation in earlier years than in later years? A) the units-of-production method B) the straight-line method C) the double-declining-balance method D) the first-in, first-out method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts