Question: 3:24 ol 5Ge Done & myopenmath.com A C, unit 1: Personal Finance Quiz Score: 8.8/22 9/21 answered Progress saved Done '[ @ @ Question 12

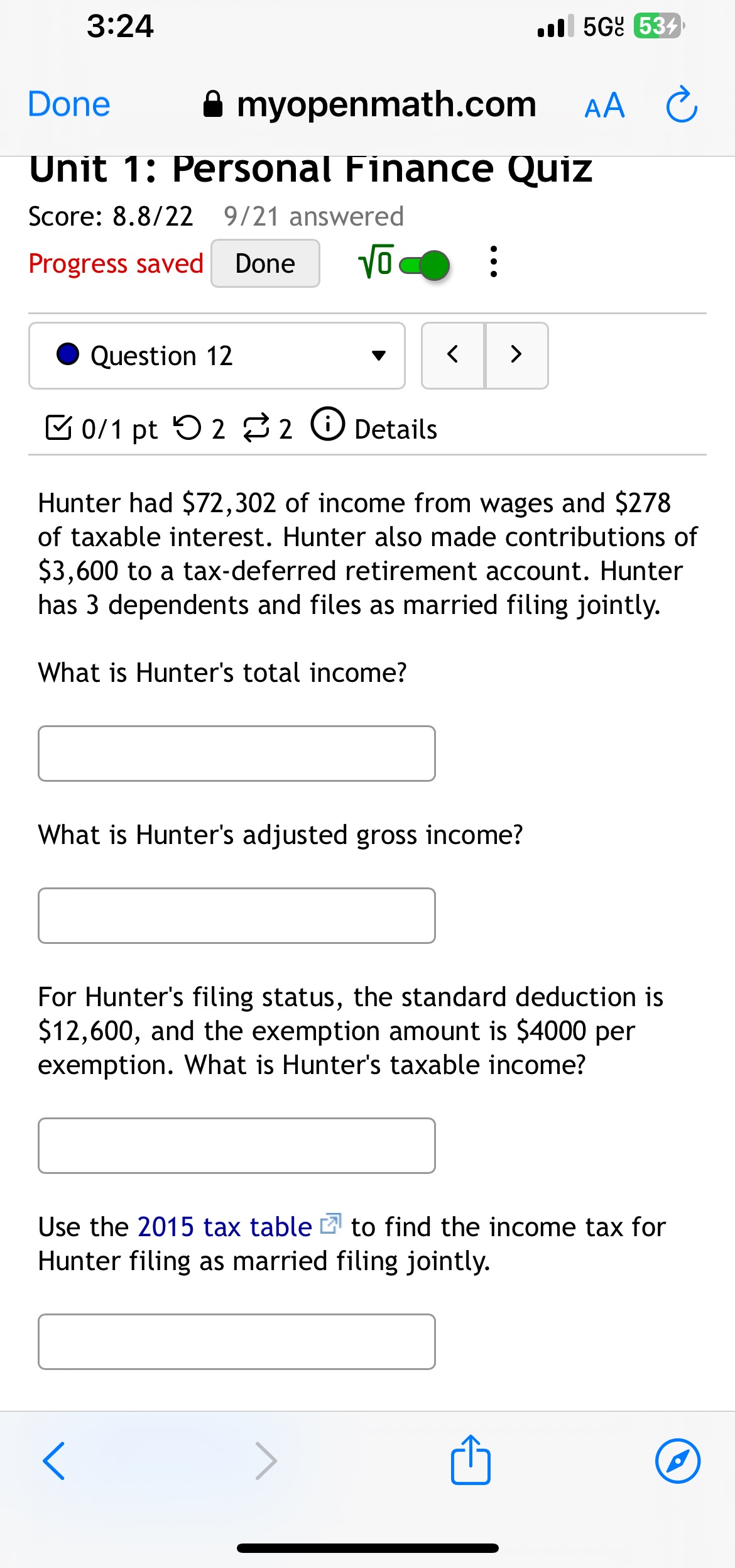

3:24 ol 5Ge Done & myopenmath.com A C, unit 1: Personal Finance Quiz Score: 8.8/22 9/21 answered Progress saved Done '\\[ @ @ Question 12 v o/1pt 2 22 O Details Hunter had $72,302 of income from wages and $278 of taxable interest. Hunter also made contributions of $3,600 to a tax-deferred retirement account. Hunter has 3 dependents and files as married filing jointly. What is Hunter's total income? What is Hunter's adjusted gross income? For Hunter's filing status, the standard deduction is $12,600, and the exemption amount is $4000 per exemption. What is Hunter's taxable income? Use the 2015 tax table [ to find the income tax for Hunter filing as married filing jointly.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts