Question: #33 #5/2018 Bookshelf Online: 2018 CFA Program Level I Volume 5 Equity and Fixed In PRINTED BY: akazemi@ric.edu. Printing is for personal, private use only.

#33

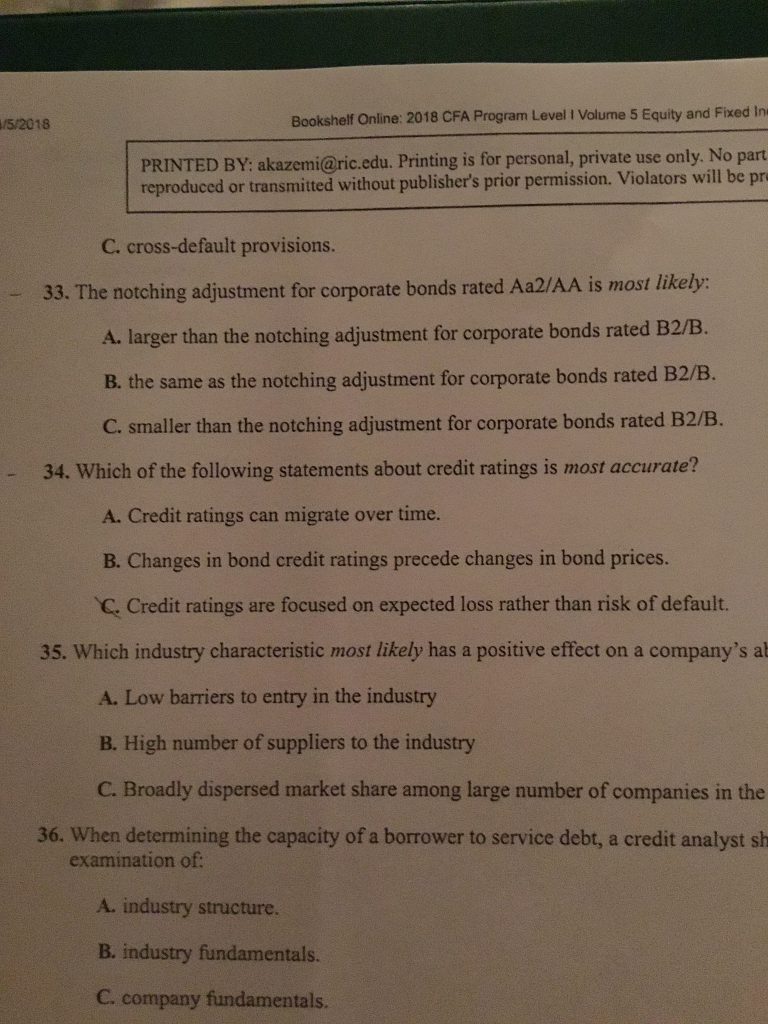

#5/2018 Bookshelf Online: 2018 CFA Program Level I Volume 5 Equity and Fixed In PRINTED BY: akazemi@ric.edu. Printing is for personal, private use only. No part reproduced or transmitted without publisher's prior permission. Violators will be pr C. cross-default provisions 33. The notching adjustment for corporate bonds rated Aa2/AA is most likely: bonds rated B2/B. A. larger than the notching adjustment for corporate B. the same as the notching adjustment for corporate bonds rated B2/B. C. smaller than the notching adjustment for corporate bonds rated B2/B. 34. Which of the following statements about credit ratings is most accurate? A. Credit ratings can migrate over time. B. Changes in bond credit ratings precede changes in bond prices. C. Credit ratings are focused on expected loss rather than risk of default. 35. Which industry characteristic most likely has a positive effect on a company's ab A. Low barriers to entry in the industry B. High number of suppliers to the industry C. Broadly dispersed market share among large number of companies in the 36. When determining the capacity of a borrower to service debt, a credit analyst sh examination of: A. industry structure. B. industry fundamentals. C. company fundamentals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts