Question: 33. At a current contribution margin% of 80% how much must sales decrease by for a price increase of 6% not to be worth while?

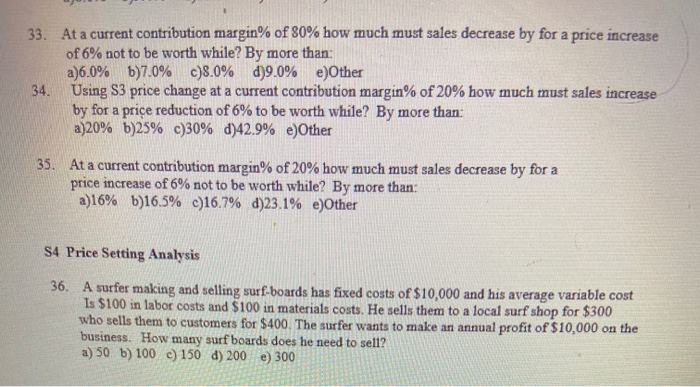

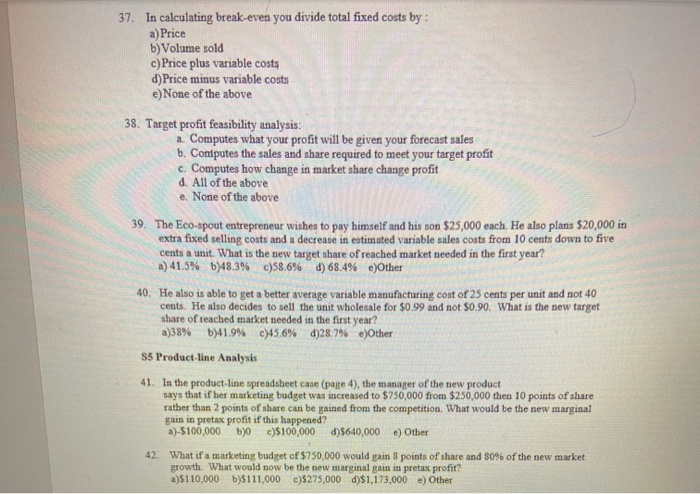

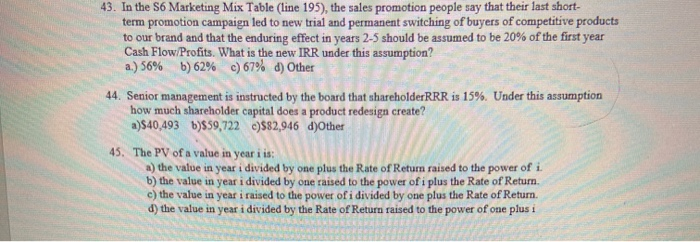

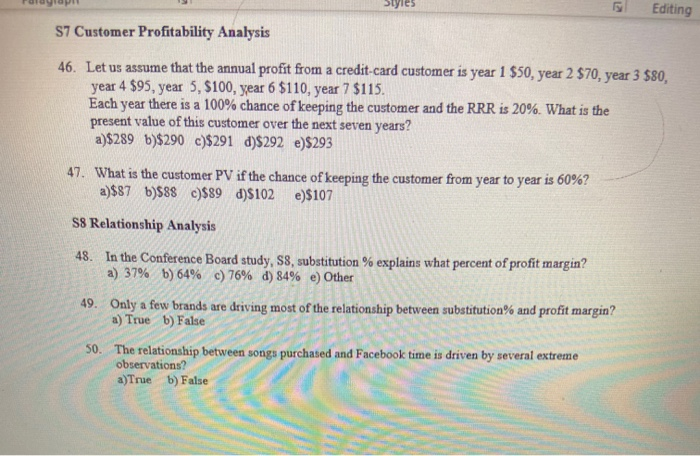

33. At a current contribution margin% of 80% how much must sales decrease by for a price increase of 6% not to be worth while? By more than: a)6.0% b)7.0% c)8.0% d)9.0% e)Other 34. Using S3 price change at a current contribution margin% of 20% how much must sales increase by for a price reduction of 6% to be worth while? By more than: a)20% b)25% c)30% d)42.9% e)Other 35. At a current contribution margin% of 20% how much must sales decrease by for a price increase of 6% not to be worth while? By more than: a)16% b)16.5% c)16.7% d)23.1% e)Other S4 Price Setting Analysis 36. A surfer making and selling surf-boards has fixed costs of $10,000 and his average variable cost Is $100 in labor costs and $100 in materials costs. He sells them to a local surf shop for $300 who sells them to customers for $400. The surfer wants to make an annual profit of $10,000 on the business. How many surf boards does he need to sell? a) 50 b) 100 c) 150 d) 200 e) 300 37. In calculating break-even you divide total fixed costs by: a) Price b) Volume sold c)Price plus variable costs d) Price minus variable costs e) None of the above 38. Target profit feasibility analysis: a. Computes what your profit will be given your forecast sales b. Consputes the sales and share required to meet your target profit c. Computes how change in market share change profit d. All of the above e. None of the above 39. The Eco-spout entrepreneur wishes to pay himself and his son $25,000 each. He also plans $20,000 in extra fixed selling costs and a decrease in estimated variable sales costs from 10 cents down to five cents a unit. What is the new target share of reached market needed in the first year? a) 41.5% b)48.3% c)58.6% d) 68.4% e)Other 40. He also is able to get a better average variable manufacturing cost of 25 cents per unit and not 40 cents. He also decides to sell the unit wholesale for $0.99 and not $0.90. What is the new target share of reached market needed in the first year? a)38% b)41.9% c)45.6% d)28.7% e)Other S5 Product line Analysis 41. In the product-line spreadsheet case (page 4), the manager of the new product says that if her marketing budget was increased to $750,000 from $250,000 then 10 points of share rather than 2 points of share can be gained from the competition. What would be the new marginal gain in pretax profit if this happened? a)-$100,000 b) c)$100,000 d)$640,000 e) Other What if a marketing budget of $750,000 would gain 8 points of share and 80% of the new market growth. What would now be the new marginal gain in pretax profit? a)$110,000 b)$111.000 c)$275,000 d)$1,173,000 e) Other styles Editing S7 Customer Profitability Analysis 46. Let us assume that the annual profit from a credit card customer is year 1 $50, year 2 $70, year 3 $80. year 4 $95, year 5, $100, year 6 $110, year 7 $115. Each year there is a 100% chance of keeping the customer and the RRR is 20%. What is the present value of this customer over the next seven years? a)$289 b)$290 c)$291 d)$292 e)$293 47. What is the customer PV if the chance of keeping the customer from year to year is 60%? a)$87 b)588 c)$89 d)$102 e)$107 S8 Relationship Analysis 48. In the Conference Board study, S8, substitution % explains what percent of profit margin? a) 37% b) 64% c) 76% d) 84% e) Other 49. Only a few brands are driving most of the relationship between substitution% and profit margin? a) True b) False 50. The relationship between songs purchased and Facebook time is driven by several extreme observations? a)Treb) False 33. At a current contribution margin% of 80% how much must sales decrease by for a price increase of 6% not to be worth while? By more than: a)6.0% b)7.0% c)8.0% d)9.0% e)Other 34. Using S3 price change at a current contribution margin% of 20% how much must sales increase by for a price reduction of 6% to be worth while? By more than: a)20% b)25% c)30% d)42.9% e)Other 35. At a current contribution margin% of 20% how much must sales decrease by for a price increase of 6% not to be worth while? By more than: a)16% b)16.5% c)16.7% d)23.1% e)Other S4 Price Setting Analysis 36. A surfer making and selling surf-boards has fixed costs of $10,000 and his average variable cost Is $100 in labor costs and $100 in materials costs. He sells them to a local surf shop for $300 who sells them to customers for $400. The surfer wants to make an annual profit of $10,000 on the business. How many surf boards does he need to sell? a) 50 b) 100 c) 150 d) 200 e) 300 37. In calculating break-even you divide total fixed costs by: a) Price b) Volume sold c)Price plus variable costs d) Price minus variable costs e) None of the above 38. Target profit feasibility analysis: a. Computes what your profit will be given your forecast sales b. Consputes the sales and share required to meet your target profit c. Computes how change in market share change profit d. All of the above e. None of the above 39. The Eco-spout entrepreneur wishes to pay himself and his son $25,000 each. He also plans $20,000 in extra fixed selling costs and a decrease in estimated variable sales costs from 10 cents down to five cents a unit. What is the new target share of reached market needed in the first year? a) 41.5% b)48.3% c)58.6% d) 68.4% e)Other 40. He also is able to get a better average variable manufacturing cost of 25 cents per unit and not 40 cents. He also decides to sell the unit wholesale for $0.99 and not $0.90. What is the new target share of reached market needed in the first year? a)38% b)41.9% c)45.6% d)28.7% e)Other S5 Product line Analysis 41. In the product-line spreadsheet case (page 4), the manager of the new product says that if her marketing budget was increased to $750,000 from $250,000 then 10 points of share rather than 2 points of share can be gained from the competition. What would be the new marginal gain in pretax profit if this happened? a)-$100,000 b) c)$100,000 d)$640,000 e) Other What if a marketing budget of $750,000 would gain 8 points of share and 80% of the new market growth. What would now be the new marginal gain in pretax profit? a)$110,000 b)$111.000 c)$275,000 d)$1,173,000 e) Other styles Editing S7 Customer Profitability Analysis 46. Let us assume that the annual profit from a credit card customer is year 1 $50, year 2 $70, year 3 $80. year 4 $95, year 5, $100, year 6 $110, year 7 $115. Each year there is a 100% chance of keeping the customer and the RRR is 20%. What is the present value of this customer over the next seven years? a)$289 b)$290 c)$291 d)$292 e)$293 47. What is the customer PV if the chance of keeping the customer from year to year is 60%? a)$87 b)588 c)$89 d)$102 e)$107 S8 Relationship Analysis 48. In the Conference Board study, S8, substitution % explains what percent of profit margin? a) 37% b) 64% c) 76% d) 84% e) Other 49. Only a few brands are driving most of the relationship between substitution% and profit margin? a) True b) False 50. The relationship between songs purchased and Facebook time is driven by several extreme observations? a)Treb) False