Question: 33. For tax reporting purposes, when should a lessor recognize income from a percentage rent arrangement? A. Never; percentage rents are not taxable to the

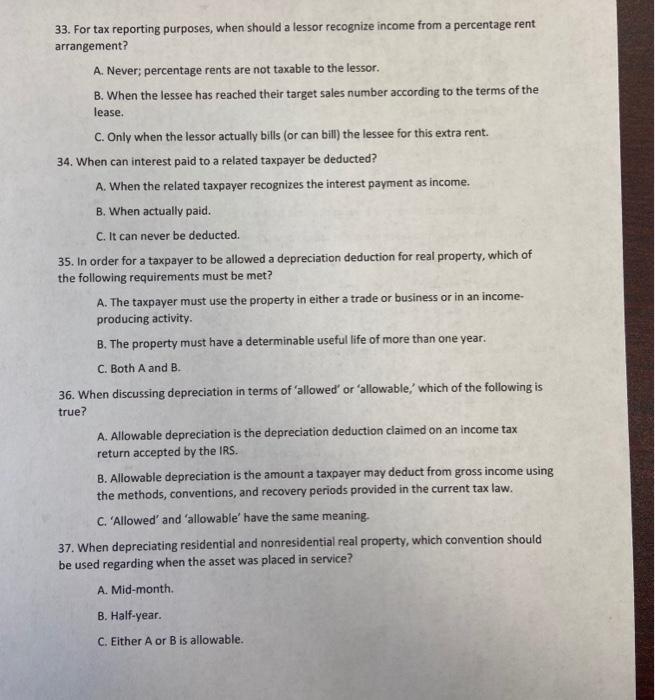

33. For tax reporting purposes, when should a lessor recognize income from a percentage rent arrangement? A. Never; percentage rents are not taxable to the lessor. B. When the lessee has reached their target sales number according to the terms of the lease. C. Only when the lessor actually bills (or can bill) the lessee for this extra rent. 34. When can interest paid to a related taxpayer be deducted? A. When the related taxpayer recognizes the interest payment as income. B. When actually paid. C. It can never be deducted. 35. In order for a taxpayer to be allowed a depreciation deduction for real property, which of the following requirements must be met? A. The taxpayer must use the property in either a trade or business or in an income producing activity B. The property must have a determinable useful life of more than one year. C. Both A and B. 36. When discussing depreciation in terms of allowed' or 'allowable,' which of the following is true? A. Allowable depreciation is the depreciation deduction claimed on an income tax return accepted by the IRS. B. Allowable depreciation is the amount a taxpayer may deduct from gross income using the methods, conventions, and recovery periods provided in the current tax law. C. 'Allowed' and 'allowable' have the same meaning. 37. When depreciating residential and nonresidential real property, which convention should be used regarding when the asset was placed in service? A. Mid-month. B. Half-year. C. Either A or B is allowable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts