Question: 33. Frank bought a nonqualified temporary variable annuity for $100,000, providing periodic payments for ten years. If payments are $15,000 annually, how much of each

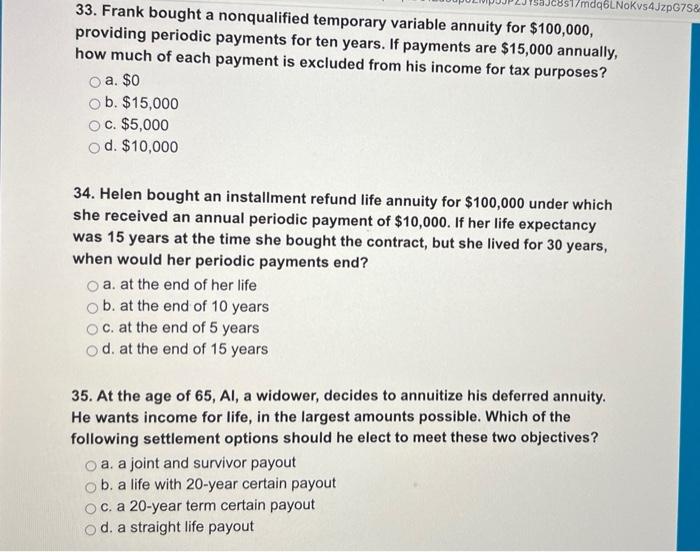

33. Frank bought a nonqualified temporary variable annuity for $100,000, providing periodic payments for ten years. If payments are $15,000 annually, how much of each payment is excluded from his income for tax purposes? a. $0 b. $15,000 c. $5,000 d. $10,000 34. Helen bought an installment refund life annuity for $100,000 under which she received an annual periodic payment of $10,000. If her life expectancy was 15 years at the time she bought the contract, but she lived for 30 years, when would her periodic payments end? a. at the end of her life b. at the end of 10 years c. at the end of 5 years d. at the end of 15 years 35. At the age of 65,Al, a widower, decides to annuitize his deferred annuity. He wants income for life, in the largest amounts possible. Which of the following settlement options should he elect to meet these two objectives? a. a joint and survivor payout b. a life with 20 -year certain payout c. a 20-year term certain payout d. a straight life payout

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts