Question: 33. There is a 5-year project that is expected to generate $32 million of cash revenue per year for the first 3 years and then

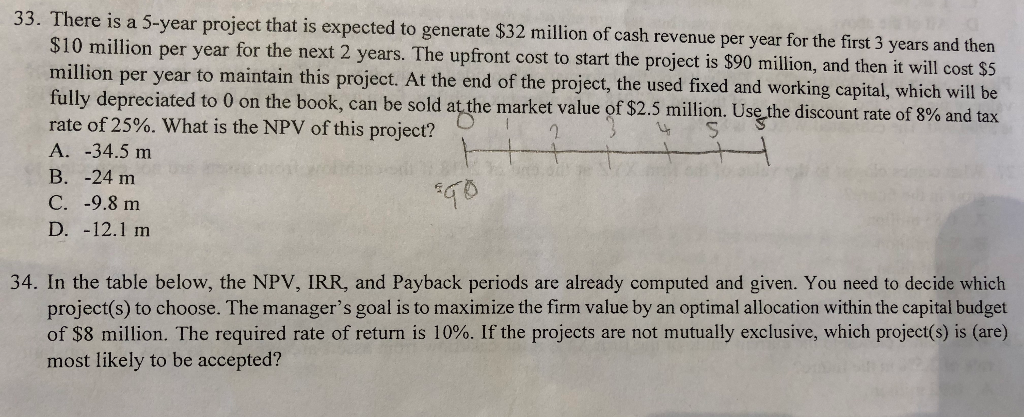

33. There is a 5-year project that is expected to generate $32 million of cash revenue per year for the first 3 years and then ears. The upfront cost to start the project is $90 million, and then it will cost $5 $10 million per year for the next 2y llion per year to maintain this project. At the end of the project, the used fixed and working capital, which will be fully depreciated to 0 on the book, can be sold at he market value of $2.5 million. Us the discount rate of 8% rate of 25%. What is the NPV of this project? A. -34.5 m B. -24 m and tax D. -12.1 m 34. In the table below, the NPV, IRR, and Payback periods are already computed and given. You need to decide which project(s) to choose. The manager's goal is to maximize the firm value by an optimal allocation within the capital budget of $8 million. The required rate of return is 10%. If the projects are not mutually exclusive, which project(s) is (are) most likely to be accepted? 33. There is a 5-year project that is expected to generate $32 million of cash revenue per year for the first 3 years and then ears. The upfront cost to start the project is $90 million, and then it will cost $5 $10 million per year for the next 2y llion per year to maintain this project. At the end of the project, the used fixed and working capital, which will be fully depreciated to 0 on the book, can be sold at he market value of $2.5 million. Us the discount rate of 8% rate of 25%. What is the NPV of this project? A. -34.5 m B. -24 m and tax D. -12.1 m 34. In the table below, the NPV, IRR, and Payback periods are already computed and given. You need to decide which project(s) to choose. The manager's goal is to maximize the firm value by an optimal allocation within the capital budget of $8 million. The required rate of return is 10%. If the projects are not mutually exclusive, which project(s) is (are) most likely to be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts