Question: 33. What is the difference between the forward price and the value of a forward contract? * [t] (5 Points) The value of a forward

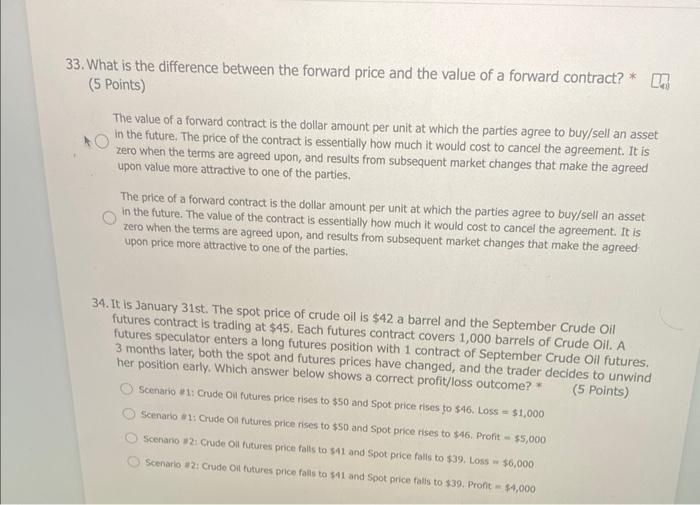

33. What is the difference between the forward price and the value of a forward contract? * [t] (5 Points) The value of a forward contract is the dollar amount per unit at which the parties agree to buy/sell an asset in the future. The price of the contract is essentially how much it would cost to cancel the agreement. It is zero when the terms are agreed upon, and results from subsequent market changes that make the agreed upon value more attractive to one of the parties. The price of a forward contract is the dollar amount per unit at which the parties agree to buy/sell an asset in the future. The value of the contract is essentially how much it would cost to cancel the agreement. It is zero when the terms are agreed upon, and results from subsequent market changes that make the agreed upon price more attractive to one of the parties. 34. It is January 31 st. The spot price of crude oil is $42 a barrel and the September Crude Oil futures contract is trading at $45. Each futures contract covers 1,000 barrels of Crude Oil. A futures speculator enters a long futures position with 1 contract of September Crude Oil futures. 3 months later, both the spot and futures prices have changed, and the trader decides to unwind her position early. Which answer below shows a correct profit/loss outcome? * ( 5 Points) Scenario *1: Crude Oil futures price rises to $50 and Spot price rises to $46. Loss =$1,000 Scenario a1: Crude On futures, price rises to $50 and Spot price rises to $46, Profit =$5,000 Scenario 22 Crude Oil futures price falls to $11 and Spot price falls to $39, Loss $6,000 Scenario a2: Crude Oil futures price falls to $11 and $pot price falls to $39. Pront =$4,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts