Question: 330000 per year over its useful life. A scrap value of R100 000 (not included in the figures above) is anticipated for act X only.

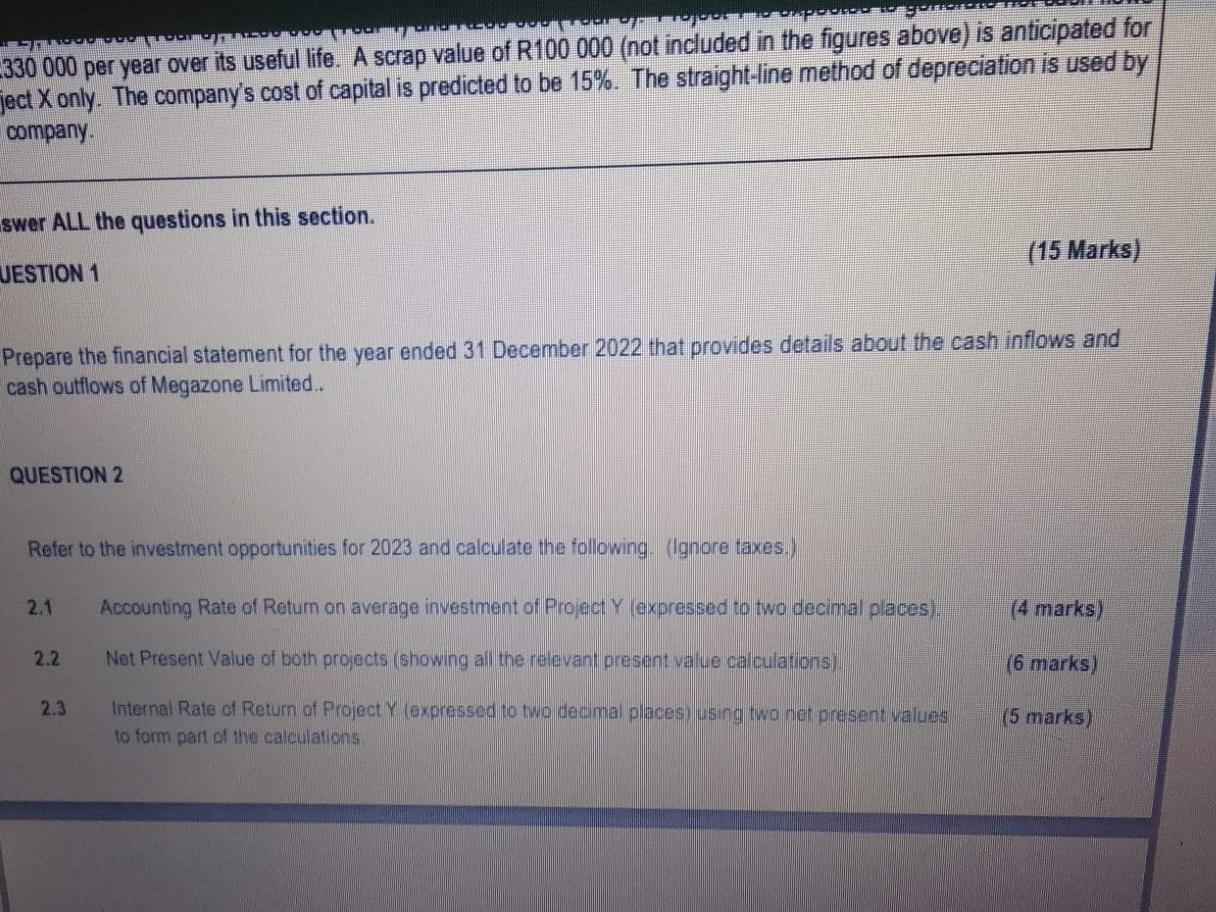

330000 per year over its useful life. A scrap value of R100 000 (not included in the figures above) is anticipated for act X only. The company's cost of capital is predicted to be 15%. The straight-line method of depreciation is used by company. wer ALL the questions in this section. (15 Marks) IESTION 1 Pepare the financial statement for the year ended 31 December 2022 that provides details about the cash inflows and cash outflows of Megazone Limited. QUESTION 2 Refer to the investment opportunities for 2023 and calculate the following. (lgnore taxes.) 2.1 Accounting Rate of Return on average investment of Project Y (expressed to two decimal places). (4 marks) 2.2 Net Present Value of both projects (showing all the relevant present value calculations). (6 marks) 2.3 Internal Rate of Return of Project Y (expressed to two decimal places) using two net present values (5 marks) 330000 per year over its useful life. A scrap value of R100 000 (not included in the figures above) is anticipated for act X only. The company's cost of capital is predicted to be 15%. The straight-line method of depreciation is used by company. wer ALL the questions in this section. (15 Marks) IESTION 1 Pepare the financial statement for the year ended 31 December 2022 that provides details about the cash inflows and cash outflows of Megazone Limited. QUESTION 2 Refer to the investment opportunities for 2023 and calculate the following. (lgnore taxes.) 2.1 Accounting Rate of Return on average investment of Project Y (expressed to two decimal places). (4 marks) 2.2 Net Present Value of both projects (showing all the relevant present value calculations). (6 marks) 2.3 Internal Rate of Return of Project Y (expressed to two decimal places) using two net present values

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts