Question: 3320: Unit 1 Project LG1 and LG2 Learning Objectives: e LGI: Prioritize different types of debts to successfully navigating payment options. e LG2: Understand how

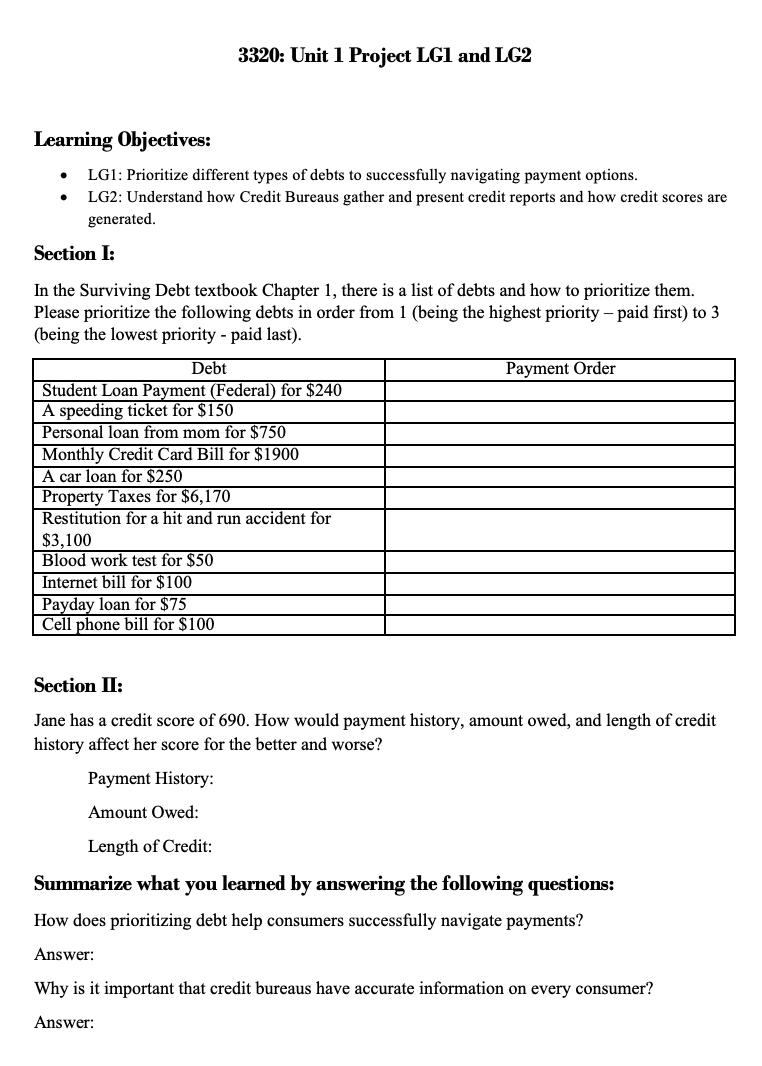

3320: Unit 1 Project LG1 and LG2 Learning Objectives: e LGI: Prioritize different types of debts to successfully navigating payment options. e LG2: Understand how Credit Bureaus gather and present credit reports and how credit scores are generated. Section I: In the Surviving Debt textbook Chapter 1, there is a list of debts and how to prioritize them. Please prioritize the following debts in order from 1 (being the highest priority paid first) to 3 (being the lowest priority - paid last). Dbt [ PomemOde | Restitution for a hit and run accident for $3,100 A car loan for $250 ' ] Property Taxes for $6,170 ] Section II: Jane has a credit score of 690. How would payment history, amount owed, and length of credit history affect her score for the better and worse? Payment History: Amount Owed: Length of Credit: Summarize what you learned by answering the following questions: How does prioritizing debt help consumers successfully navigate payments? Answer: Why is it important that credit bureaus have accurate information on every consumer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts