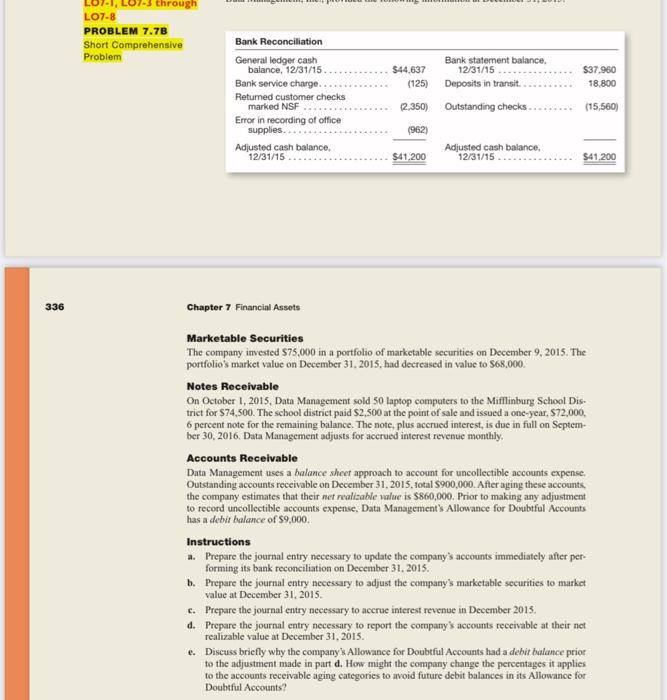

Question: 336 LO7-1, LO7-3 through LO7-8 PROBLEM 7.7B Short Comprehensive Problem Bank Reconciliation General ledger cash balance, 12/31/15 Bank service charge. Returned customer checks marked NSF

LOT-8 PROBLEM 7.7B Short Comprehenslve Problem Chapter 7 Financial Assets Marketable Securities The company invested $75,000 in a portfolio of marketable securities on December 9,2015. The portfolio's market value on December 31, 2015, had decreased in value to $68,000. Notes Receivable On October 1, 2015, Data Management sold 50 laptop computers to the Mifllinburg School Dis. trict for $74,500. The school district paid $2,500 at the point of sale and issued a one-year, $72,000, 6 percent note for the remaining balance. The note, plus acerued interest, is due in full on September 30, 2016. Data Management adjusts for acerued interest revenue monthly. Accounts Receivable Data Management uses a balance sheet approach to account for uncollectible accounts expense. Outstanding accounts receivable on December 31, 2015, total 5900,000 . After aging these accounts. the company estimates that their net realizable value is $860,000. Prior to making any adjustment to record uncollectible accounts expense, Data Management's Allowance for Doubtful Accounts has a debit balance of $9,000. Instructions a. Prepare the journal entry necessary to update the company's accounts immediately after performing its bank reconciliation on December 31. 2015. b. Prepare the journal entry necessary to adjust the company's marketable securities to market value at December 31, 2015. c. Prepare the journal entry necessary to accrue interest revenue in December 2015. d. Prepare the journal entry necessary to report the company's accounts receivable at their net realizable value at December 31, 2015. e. Discuss briefly why the company's Allowance for Doubtful Accounts had a debit bulance prior to the adjustment made in part d. How might the company change the percentages it applies to the accounts receivable aging categories to avoid future debit balances in its Allowance for Doubtful Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts