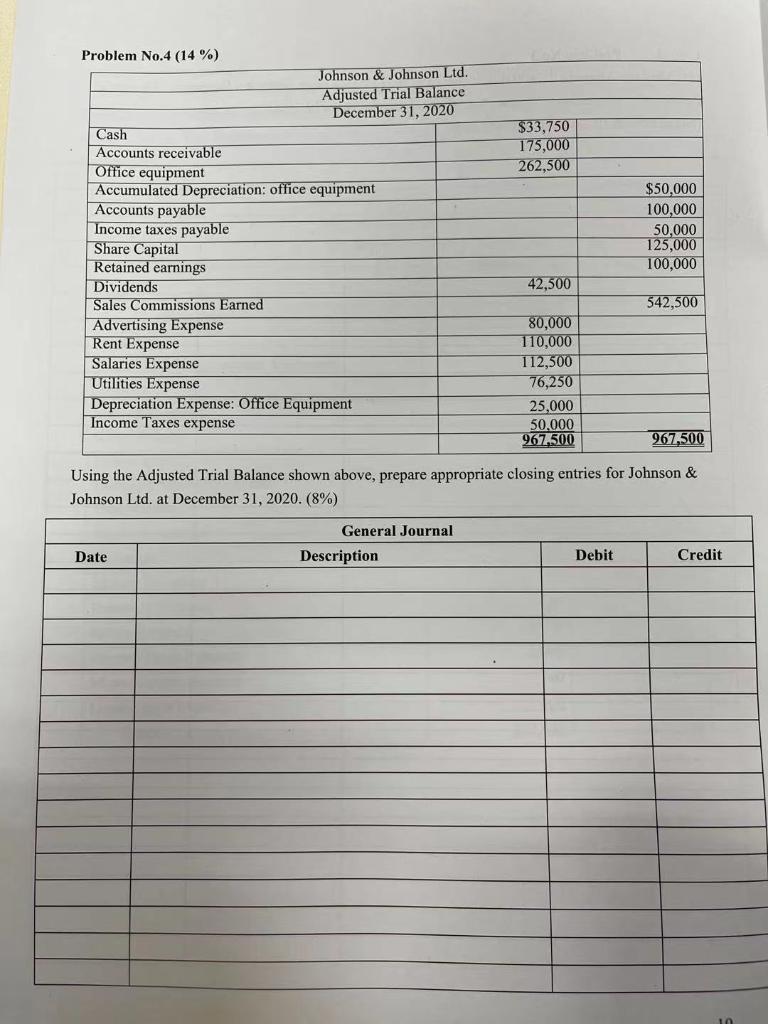

Question: $33,750 175,000 262,500 Problem No.4 (14 %) Johnson & Johnson Ltd. Adjusted Trial Balance December 31, 2020 Cash Accounts receivable Office equipment Accumulated Depreciation: office

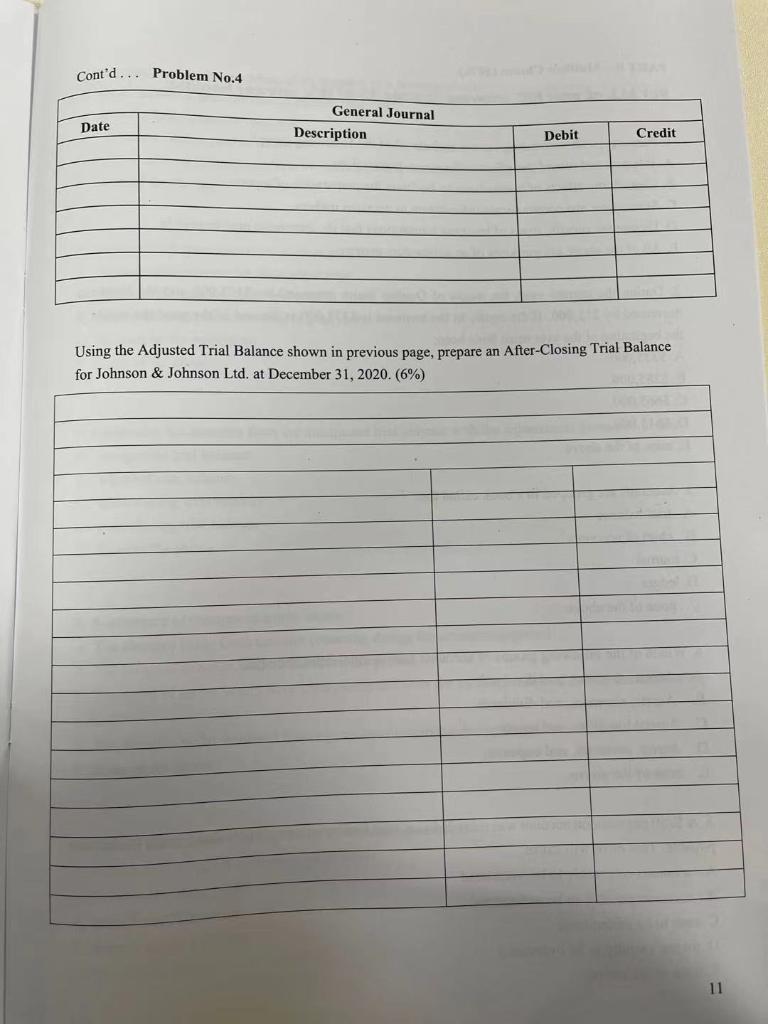

$33,750 175,000 262,500 Problem No.4 (14 %) Johnson & Johnson Ltd. Adjusted Trial Balance December 31, 2020 Cash Accounts receivable Office equipment Accumulated Depreciation: office equipment Accounts payable Income taxes payable Share Capital Retained earnings Dividends Sales Commissions Earned Advertising Expense Rent Expense Salaries Expense Utilities Expense Depreciation Expense: Office Equipment Income Taxes expense $50,000 100,000 50,000 125,000 100,000 42,500 542,500 80,000 110,000 112,500 76,250 25,000 50.000 967,500 967,500 Using the Adjusted Trial Balance shown above, prepare appropriate closing entries for Johnson & Johnson Ltd. at December 31, 2020. (8%) General Journal Description Date Debit Credit Cont'd... Problem No.4 Date General Journal Description Debit Credit Using the Adjusted Trial Balance shown in previous page, prepare an After-Closing Trial Balance for Johnson & Johnson Ltd. at December 31, 2020. (6%) 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts