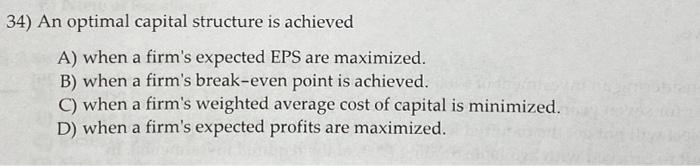

Question: 34) An optimal capital structure is achieved A) when a firm's expected EPS are maximized. B) when a firm's break-even point is achieved. C) when

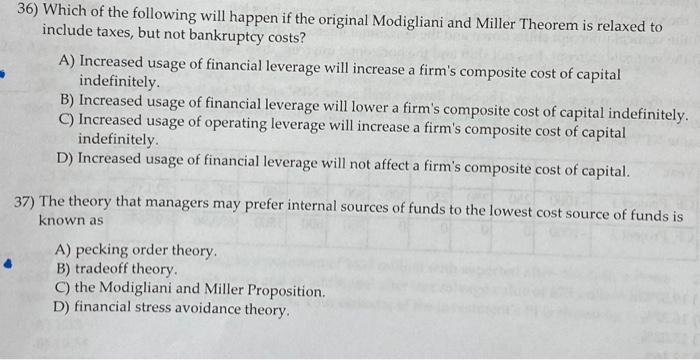

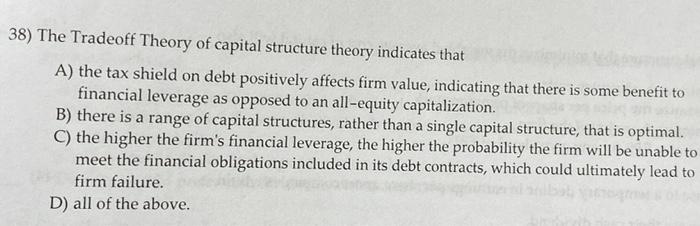

34) An optimal capital structure is achieved A) when a firm's expected EPS are maximized. B) when a firm's break-even point is achieved. C) when a firm's weighted average cost of capital is minimized. D) when a firm's expected profits are maximized. 36) Which of the following will happen if the original Modigliani and Miller Theorem is relaxed to include taxes, but not bankruptcy costs? A) Increased usage of financial leverage will increase a firm's composite cost of capital indefinitely. B) Increased usage of financial leverage will lower a firm's composite cost of capital indefinitely. C) Increased usage of operating leverage will increase a firm's composite cost of capital indefinitely. D) Increased usage of financial leverage will not affect a firm's composite cost of capital. 37) The theory that managers may prefer internal sources of funds to the lowest cost source of funds is known as A) pecking order theory. B) tradeoff theory. C) the Modigliani and Miller Proposition. D) financial stress avoidance theory. 38) The Tradeoff Theory of capital structure theory indicates that A) the tax shield on debt positively affects firm value, indicating that there is some benefit to financial leverage as opposed to an all-equity capitalization. B) there is a range of capital structures, rather than a single capital structure, that is optimal. C) the higher the firm's financial leverage, the higher the probability the firm will be unable to meet the financial obligations included in its debt contracts, which could ultimately lead to firm failure. D) all of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts