Question: 34 FINANCIAL PERFORMANCE & RISK ANALYSIS Question 3 (19 Marks) BWA Limited requires a motor vehicle for a visiting transport o is for s the

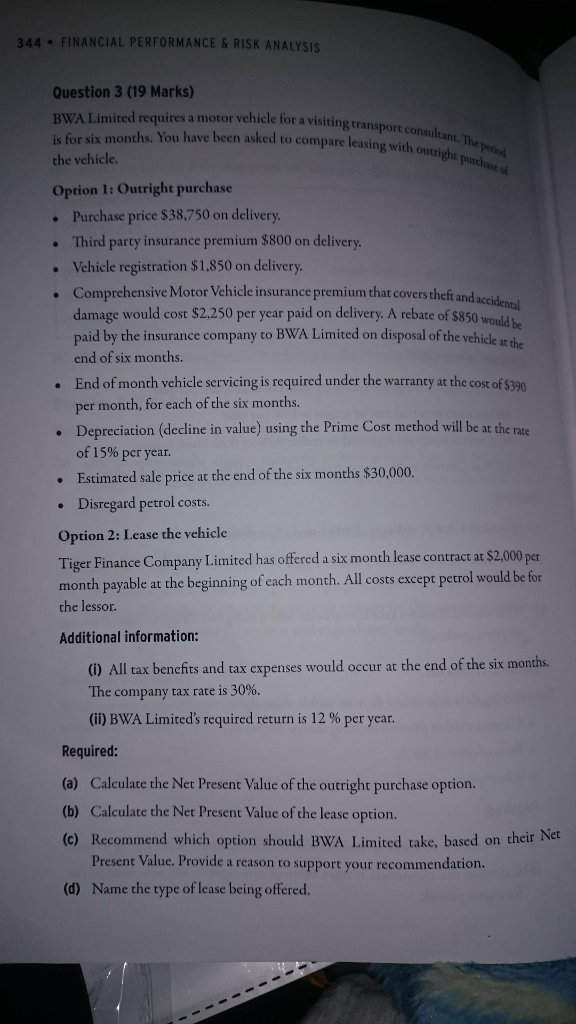

34 FINANCIAL PERFORMANCE & RISK ANALYSIS Question 3 (19 Marks) BWA Limited requires a motor vehicle for a visiting transport o is for s the vehicle. ix months. You have been asked to compare leasing with outrighu Pur Option 1: Outright purchase . Purchase price $38,750 on delivery Third party insurance premium $800 on delivery Vehicle registration $1,850 on delivery Comprehensive Motor Vehicle insurance premium that coversthef andaccidein damage would cost $2,250 per year paid on delivery, A rebate of $850 would b paid by the insurance company to BWA Limited on disposal of the vehicle at end of six months. the End of month vehicle servicing is required under the warranty at the cost of $390 per month, for each of the six months. Depreciation (decline in value) using the Prime Cost method will be at the rate of 15% per year. . Estimated sale price at the end of the six months $30,000 Disregard petrol costs. . Option 2: Lease the vehicle Tiger Finance Company Limited has offered a six month lease contract at $2,000 per month payable at the beginning of each month. All costs except petrol would be for the lessor. Additional information: () All tax benefits and tax expenses would occur at the end of the six months. The company tax rate is 30%. (ii) BWA Limited's required return is 12 % per year. Required: (a) Calculate the Net Present Value of the outright purchase option. (b) Calculate the Net Present Value of the lease option. (c) Recommend which option should BWA Limited take, based on their Net Present Value. Provide a reason to support your recommendation. Name the type of lease being offered (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts