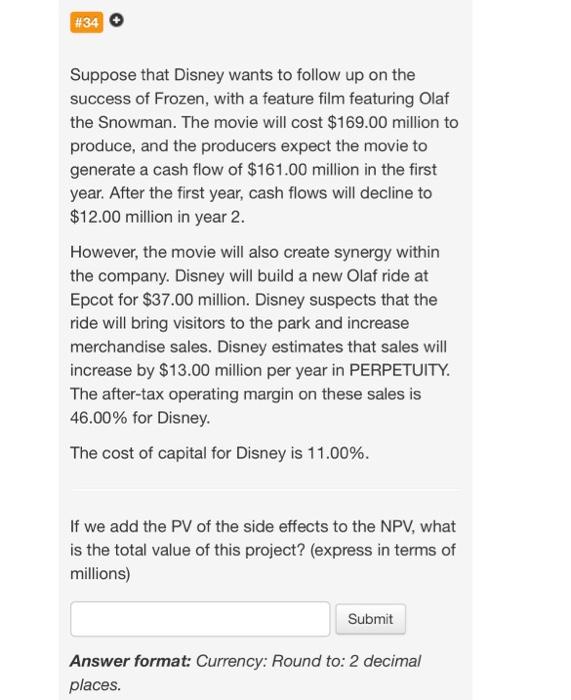

Question: 34! i need the CORRECT answer asap! I will give a thumbs up! Pleaseee! Suppose that Disney wants to follow up on the success of

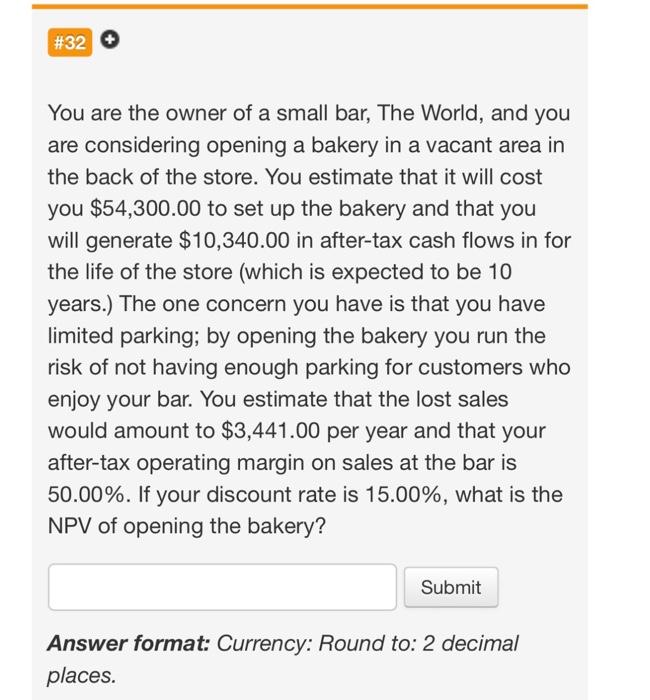

Suppose that Disney wants to follow up on the success of Frozen, with a feature film featuring Olaf the Snowman. The movie will cost $169.00 million to produce, and the producers expect the movie to generate a cash flow of $161.00 million in the first year. After the first year, cash flows will decline to $12.00 million in year 2 . However, the movie will also create synergy within the company. Disney will build a new Olaf ride at Epcot for $37.00 million. Disney suspects that the ride will bring visitors to the park and increase merchandise sales. Disney estimates that sales will increase by $13.00 million per year in PERPETUITY. The after-tax operating margin on these sales is 46.00% for Disney. The cost of capital for Disney is 11.00%. If we add the PV of the side effects to the NPV, what is the total value of this project? (express in terms of millions) Answer format: Currency: Round to: 2 decimal places. You are the owner of a small bar, The World, and you are considering opening a bakery in a vacant area in the back of the store. You estimate that it will cost you $54,300.00 to set up the bakery and that you will generate $10,340.00 in after-tax cash flows in for the life of the store (which is expected to be 10 years.) The one concern you have is that you have limited parking; by opening the bakery you run the risk of not having enough parking for customers who enjoy your bar. You estimate that the lost sales would amount to $3,441.00 per year and that your after-tax operating margin on sales at the bar is 50.00%. If your discount rate is 15.00%, what is the NPV of opening the bakery? Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts