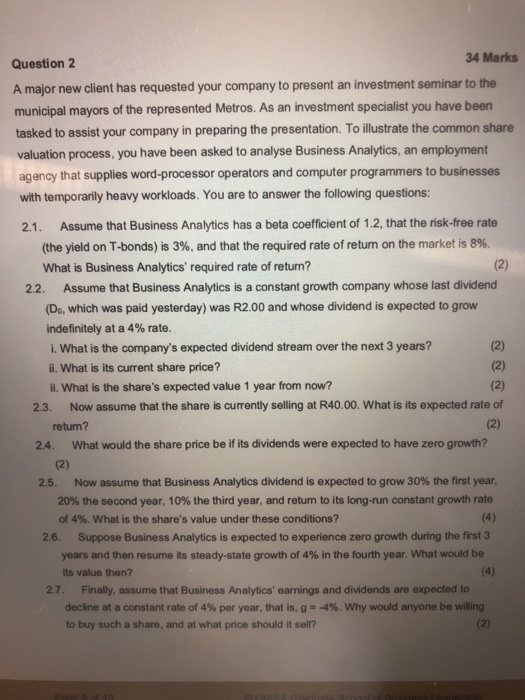

Question: 34 Marks Question 2 A major new client has requested your company to present an investment seminar to the municipal mayors of the represented Metros.

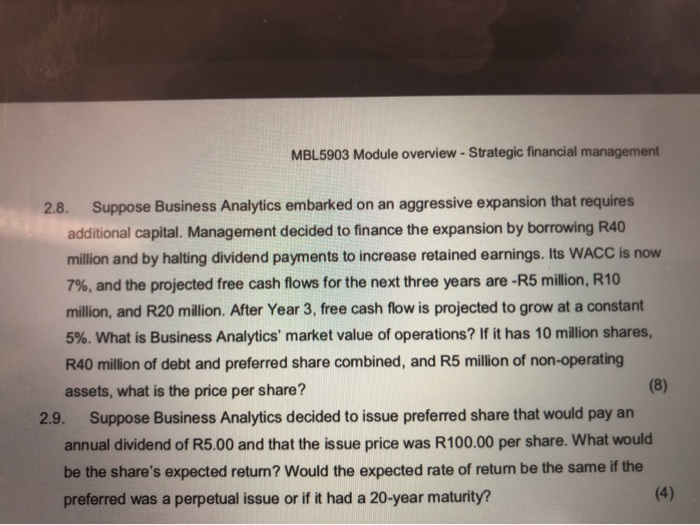

34 Marks Question 2 A major new client has requested your company to present an investment seminar to the municipal mayors of the represented Metros. As an investment specialist you have been tasked to assist your company in preparing the presentation. To illustrate the common share valuation process, you have been asked to analyse Business Analytics, an employment agency that supplies word-processor operators and computer programmers to businesses with temporarily heavy workloads. You are to answer the following questions: Assume that Business Analytics has a beta coefficient of 1.2, that the risk-free rate (the yield on T-bonds) is 3%, and that the required rate of retun on the market is 8%. What is Business Analytics' required rate of return? Assume that Business Analytics is a constant growth company whose last dividend (Do, which was paid yesterday) was R2.00 and whose dividend is expected to grow 2.1 (2) 2.2 indefinitely at a 4% rate. i. What is the company's expected dividend stream over the next 3 years? (2) (2) ii. What is its current share price? i.What is the share 's expected value 1 year from now? Now assume that the share is currently selling at R40.00. What is its expected rate of (2) 2.3. (2) retum? What would the share price be if its dividends were expected to have zero growth? 2.4. (2) Now assume that Business Analytics dividend is expected to grow 30 % the first year, 20% the second year, 10 % the third year, and returm to its long-run constant growth rate of 4%. What is the share's value under these conditions? 2.5. (4) Suppose Business Analytics is expected to experience zero growth during the first 3 2.6. years and then resume its steady-state growth of 4 % in the fourth year. What would be (4) its value then? Finally, assume that Business Analytics' earnings and dividends are expected to decline at a constant rate of 4% per year, that is, g 4 %. Why would anyone be willing to buy such a share, and at what price should it sell? 2.7. (2) MBL5903 Module overview - Strategic financial management 2.8. Suppose Business Analytics embarked on an aggressive expansion that requires additional capital. Management decided to finance the expansion by borrowing R40 million and by halting dividend payments to increase retained earnings. Its WACC is now 7%, and the projected free cash flows for the next three years are -R5 million, R10 million, and R20 million. After Year 3, free cash flow is projected to grow at a constant 5%. What is Business Analytics' market value of operations? If it has 10 million shares, R40 million of debt and preferred share combined, and R5 million of non-operating assets, what is the price per share? 2.9 (8) Suppose Business Analytics decided to issue preferred share that would pay an annual dividend of R5.00 and that the issue price was R100.00 per share. What would be the share's expected return? Would the expected rate of retun be the same if the preferred was a perpetual issue or if it had a 20-year maturity? (4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts