Question: 34. please help with A-C A B c Your brother wants to borrow $9,750 from you. He has offered to pay you back $12,250 in

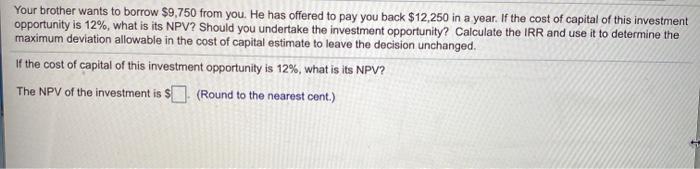

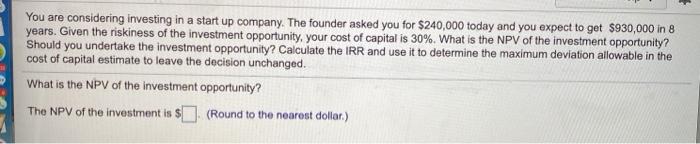

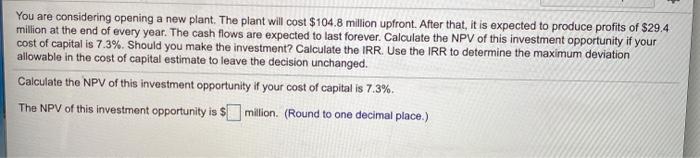

Your brother wants to borrow $9,750 from you. He has offered to pay you back $12,250 in a year. If the cost of capital of this investment opportunity is 12%, what is its NPV? Should you undertake the investment opportunity? Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. of the cost of capital of this investment opportunity is 12%, what is its NPV? The NPV of the investment is $ (Round to the nearest cent.) You are considering investing in a start up company. The founder asked you for $240,000 today and you expect to get $930,000 in 8 years. Given the riskiness of the investment opportunity, your cost of capital is 30%. What is the NPV of the investment opportunity? Should you undertake the investment opportunity? Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. What is the NPV of the investment opportunity? The NPV of the investment is $(Round to the nearest dollar) You are considering opening a new plant. The plant will cost $104.8 million upfront. After that, it is expected to produce profits of $29.4 million at the end of every year. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is 7.3%. Should you make the investment? Calculate the IRR. Use the IRR to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. Calculate the NPV of this investment opportunity if your cost of capital is 7.3%. The NPV of this investment opportunity is $ million. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts