Question: 34) When you find advisable you cannot pay your credit card bills you must take action! Which option is 34) A) Use savings to pay

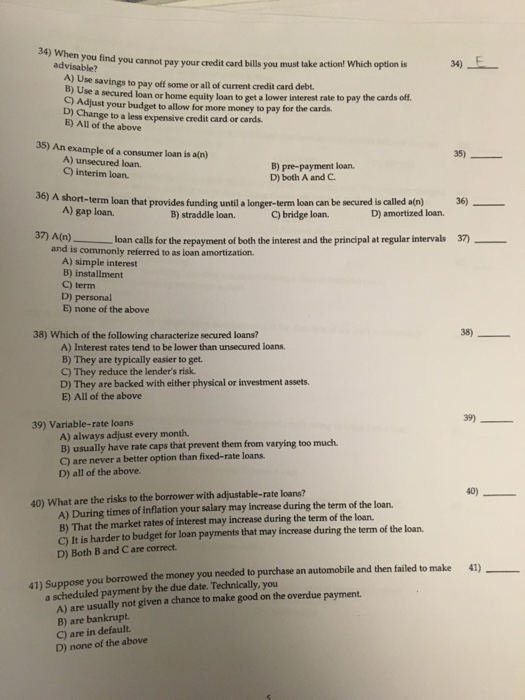

34) When you find advisable you cannot pay your credit card bills you must take action! Which option is 34) A) Use savings to pay off some or all of current credit card debt B) Use a C) Adjust your budget Di Change to a less expensive credit card or cards a secured loan or home equity loan to get a lower interest rate to pay the cards off to allow for more money to pay for the cards. E) All of the above 35) An example of a consumer loan is a(n) 35) A) unsecured loan. C) interim loan. B) pre-payment loan D) both A and C 36) A sho ort-term loan that provides funding until a longer-term loan can be secured is called a(n) A) gap loan B) straddle loan. C) bridge loan. D) amortized loan. loan calls for the repayment of both the interest and the principal at regular intervals 37) and is commonly referred to as loan amortization A) simple interest B) installment C) term D) personal E) none of the above 38) Which of the following characterize secured loans? 38) A) Interest rates tend to be lower than unsecured loans. B) They are typically easier to get C) They reduce the lender's risk. D) They are backed with either physical or investment assets. E) All of the above 39) 39) Variable-rate loans A) always adjust every month. B) usually have rate caps that prevent them from varying too much. C) are never a better option than fixed-rate loans. D) all of the above. 40) A) During times of inflation your salary may increase during the term of the loan. B) That the market rates of interest may increase during the term of the loan. C) It is harder to budget for loan payments that may increase during the term of the loan. D) Both B and C are correct 40) What are the risks to the borrower with adjustable-rate loans? 41) se you borrowed the money you needed to purchase an automobile and then failed to make 41) Suppo A) are usually not given a chance to make good on the overdue payment B) are bankrupt C) are in default D) none of the above a scheduled payment by the due date. Technically, you

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts