Question: 35 accounting help please answer all Jerri's Jewelry accepted a $2,400 note receivable from S. Wells in settlement of an overdue account receivable. The 10%

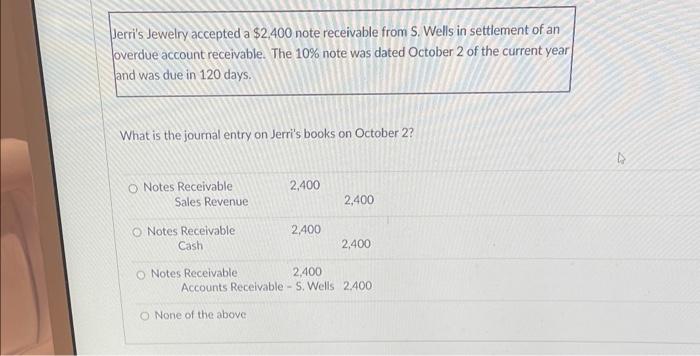

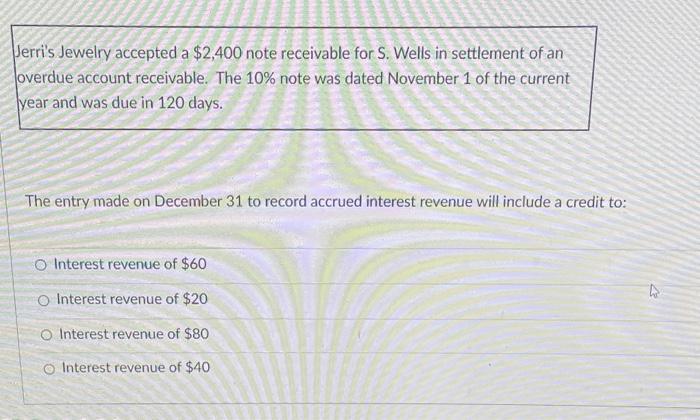

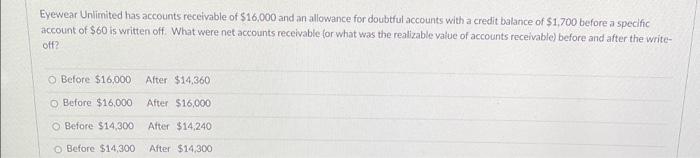

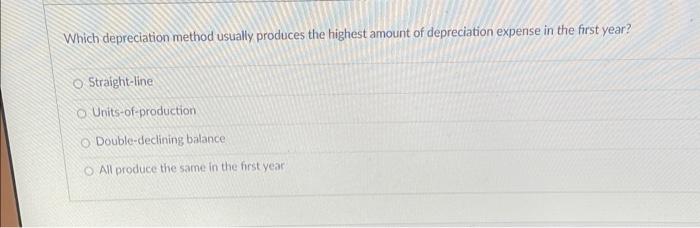

Jerri's Jewelry accepted a $2,400 note receivable from S. Wells in settlement of an overdue account receivable. The 10% note was dated October 2 of the current year and was due in 120 days. What is the journal entry on Jerri's books on October 2 ? None of the above Jerri's Jewelry accepted a $2,400 note receivable for S. Wells in settlement of an overdue account receivable. The 10% note was dated November 1 of the current year and was due in 120 days. The entry made on December 31 to record accrued interest revenue will include a credit to: Interest revenue of $60 Interest revenue of $20 Interest revenue of $80 Interest revenue of $40 Eyewear Unlimited has accounts receivable of $16,000 and an allowance for doubtful accounts with a credit balance of $1,700 before a specific account of $60 is written off. What were net accounts receivable for what was the realizablevaiue of accounts receivable) before and after the writeoff? Before $16,000 After $14,360 Before $16,000 After $16,000 Before $14,300 After $14,240 Before $14,300 After $14,300 Which depreciation method usually produces the highest amount of depreciation expense in the first year? Straight-line Units-of-production Double-declining balance All produce the same in the first year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts