Question: 3-5 can you answer question 3-5 2) Bill earns a S295,000 salary and participates in a profit-sharing plan allocating 10% of salary. What is Bill's

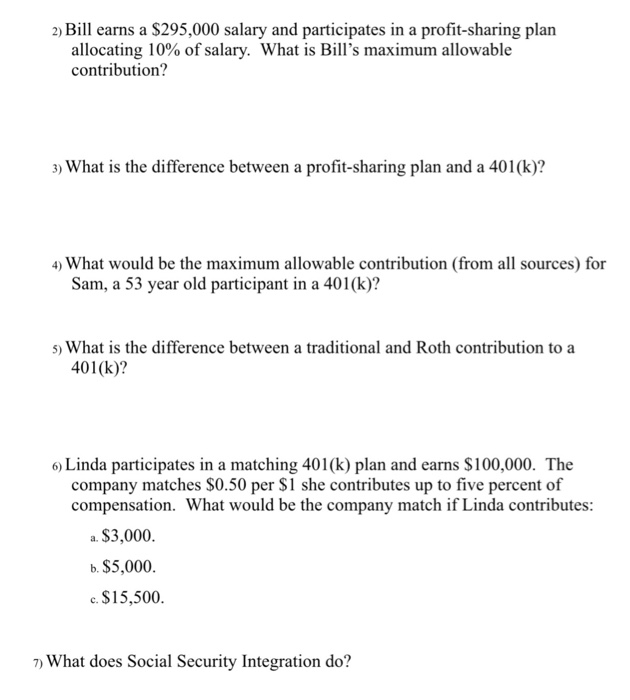

2) Bill earns a S295,000 salary and participates in a profit-sharing plan allocating 10% of salary. What is Bill's maximum allowable contribution? ) What is the difference between a profit-sharing plan and a 401(k)? ) What would be the maximum allowable contribution (from all sources) for Sam, a 53 year old participant in a 401(k)? s) What is the difference between a traditional and Roth contribution to a 401 (k)? )Linda participates in a matching 401(k) plan and earns $100,000. The company matches $0.50 per $1 she contributes up to five percent of compensation. What would be the company match if Linda contributes: a $3,000. b. $5,000 c. $15,500 ) What does Social Security Integration do

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts