Question: 3.5 points: Cash flow from assets (CFFA) is also known as Free cash flow (FCF). CFFA (or FCF) is calculated by adding Net Income to

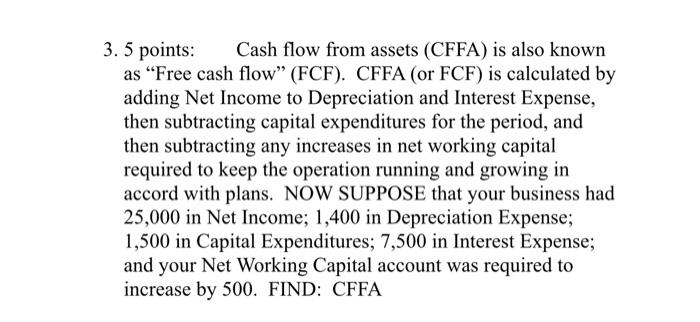

3.5 points: Cash flow from assets (CFFA) is also known as "Free cash flow" (FCF). CFFA (or FCF) is calculated by adding Net Income to Depreciation and Interest Expense, then subtracting capital expenditures for the period, and then subtracting any increases in net working capital required to keep the operation running and growing in accord with plans. NOW SUPPOSE that your business had 25,000 in Net Income; 1,400 in Depreciation Expense; 1,500 in Capital Expenditures; 7,500 in Interest Expense; and your Net Working Capital account was required to increase by 500. FIND: CFFA

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock