Question: 35. The required return on a stock is equal to which one of the following? a. (PODI)-g b. (DI/PO)/g c. Dividend yield + Capital gains

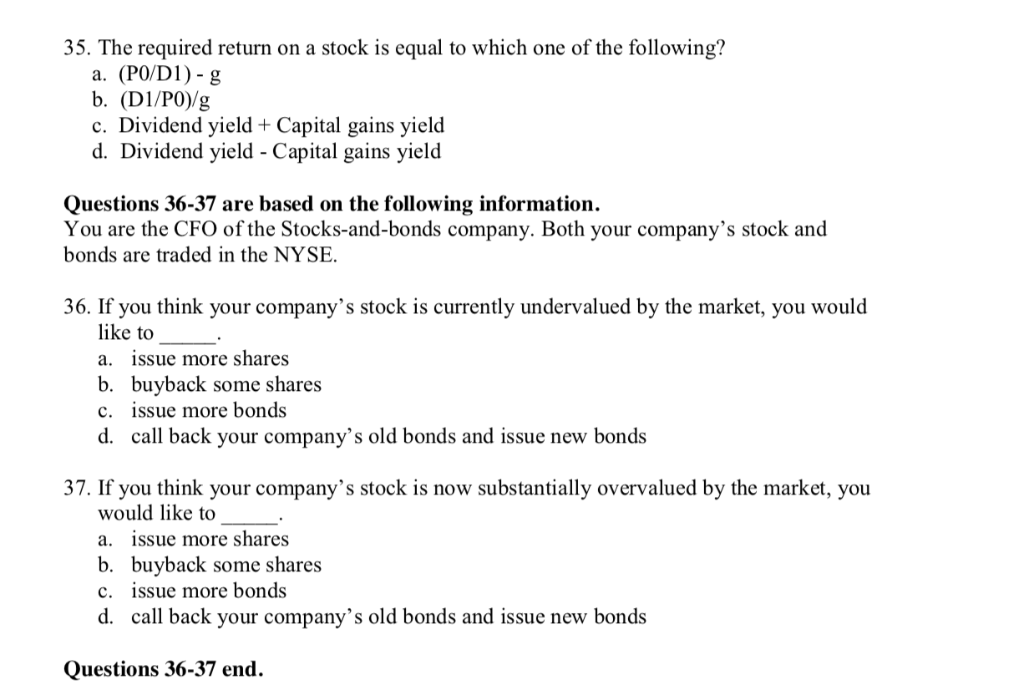

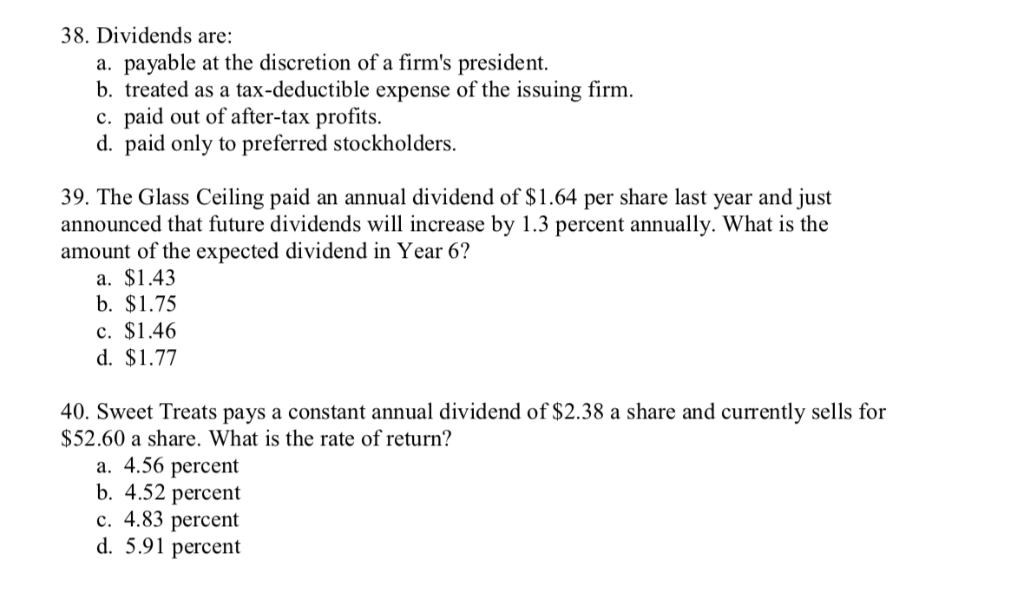

35. The required return on a stock is equal to which one of the following? a. (PODI)-g b. (DI/PO)/g c. Dividend yield + Capital gains yield d. Dividend yield Capital gains yield Questions 36-37 are based on the following information. You are the CFO of the Stocks-and-bonds company. Both your company's stock and bonds are traded in the NYSE. 36. If you think your company's stock is currently undervalued by the market, you would like to a. issue more shares b. buyback some shares c. issue more bonds d. call back your company's old bonds and issue new bonds 37. If you think your company's stock is now substantially overvalued by the market, you would like to a. issue more shares b. buyback some shares c. issue more bonds d. call back your company's old bonds and issue new bonds Questions 36-37 end. 38. Dividends are: a. payable at the discretion of a firm's president. b. treated as a tax-deductible expense of the issuing firm c. paid out of after-tax profits d. paid only to preferred stockholders 39. The Glass Ceiling paid an annual dividend of $1.64 per share last year and just announced that future dividends will increase by 1.3 percent annually. What is the amount of the expected dividend in Year 6? a. $1.43 b. $1.75 c. $1.46 40. Sweet Treats pays a constant annual dividend of $2.38 a share and currently sells for $52.60 a share. What is the rate of return? a. 4.56 percent b. 4.52 percent c. 4.83 percent d. 5.91 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts