Question: 3.5.6 I need solve this question by Excel Solver Maureen Laird is the chief financial officer for the Alva Electric Co., a major public utility

3.5.6

I need solve this question by Excel Solver

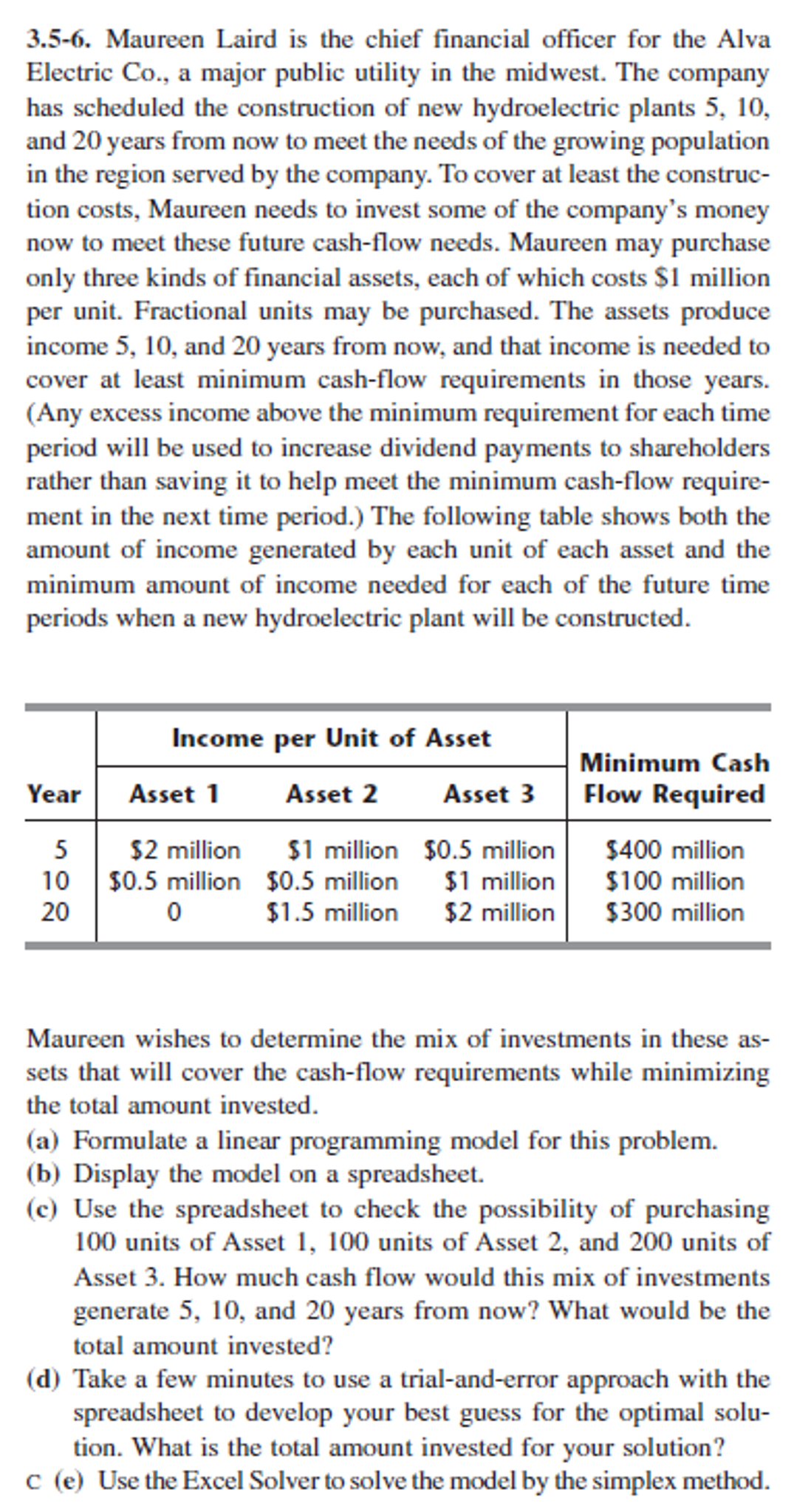

Maureen Laird is the chief financial officer for the Alva Electric Co., a major public utility in the midwest. The company has scheduled the construction of new hydroelectric plants 5, 10, and 20 years from now to meet the needs of the growing population in the region served by the company. To cover at least the construction costs, Maureen needs to invest some of the company's money now to meet these future cash-flow needs. Maureen may purchase only three kinds of financial assets, each of which costs SI million per unit. Fractional units may be purchased. The assets produce income 5, 10, and 20 years from now. and that income is needed to cover at least minimum cash-flow requirements in those years. (Any excess income above the minimum requirement for each time period will be used to increase dividend payments to shareholders rather than saving it to help meet the minimum cash-flow requirement in the next time period.) The following table shows both the amount of income generated by each unit of each asset and the minimum amount of income needed for each of the future time periods when a new hydroelectric plant will be constructed. Maureen wishes to determine the mix of investments in these assets that will cover the cash-flow requiremenLs while minimizing the total amount invested. (a) Formulate a linear programming model for this problem. (b) Display the model on a spreadsheet. (c) Use the spreadsheet to check the possibility of purchasing 100 units of Asset 1, 100 units of Asset 2, and 200 units of Asset 3. How much cash flow would this mix of investments generate 5, 10, and 20 years from now? What would be the total amount invested? (d) Take a few minutes to use a trial-and-error approach with the spreadsheet to develop your best guess for the optimal solution. What is the total amount invested for your solution? C (e) Use the Excel Solver to solve the model by the simplex method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts