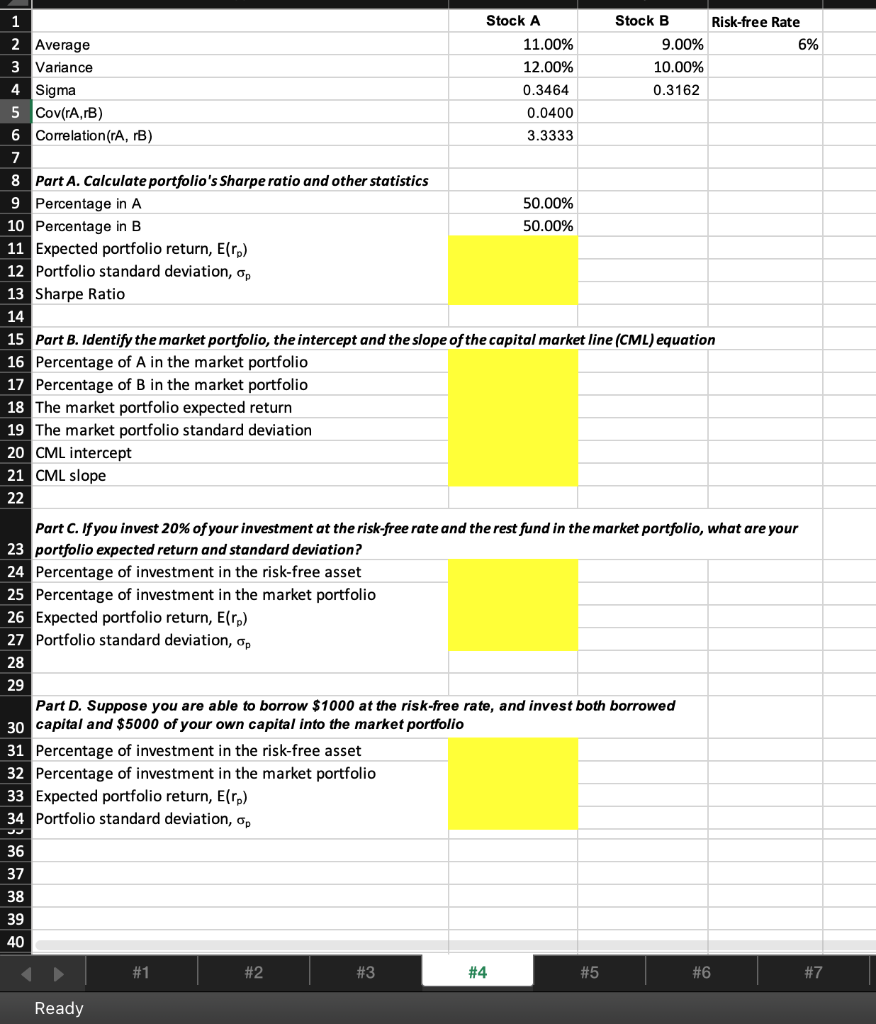

Question: 36 37 38 39 40 Stock A 1 2 Average 11.00% 9.00% 3 Variance 12.00% 10.00% 4 Sigma 0.3464 0.3162 5 Cov(rA,rB) 0.0400 6 Correlation

36 37 38 39 40 Stock A 1 2 Average 11.00% 9.00% 3 Variance 12.00% 10.00% 4 Sigma 0.3464 0.3162 5 Cov(rA,rB) 0.0400 6 Correlation (rA, rB) 3.3333 7 8 Part A. Calculate portfolio's Sharpe ratio and other statistics 9 Percentage in A 50.00% 50.00% 10 Percentage in B 11 Expected portfolio return, E(rp) 12 Portfolio standard deviation, op 13 Sharpe Ratio 14 15 Part B. Identify the market portfolio, the intercept and the slope of the capital market line (CML) equation 16 Percentage of A in the market portfolio 17 Percentage of B in the market portfolio 18 The market portfolio expected return 19 The market portfolio standard deviation 20 CML intercept 21 CML slope 22 Part C. If you invest 20% of your investment at the risk-free rate and the rest fund in the market portfolio, what are your 23 portfolio expected return and standard deviation? 24 Percentage of investment in the risk-free asset 25 Percentage of investment in the market portfolio 26 Expected portfolio return, E(rp) 27 Portfolio standard deviation, op 28 29 Part D. Suppose you are able to borrow $1000 at the risk-free rate, and invest both borrowed 30 capital and $5000 of your own capital into the market portfolio 31 Percentage of investment in the risk-free asset 32 Percentage of investment in the market portfolio 33 Expected portfolio return, E(rp) 34 Portfolio standard deviation, op #1 #2 #3 #5 #6 Ready Stock B #4 Risk-free Rate 6% #7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts