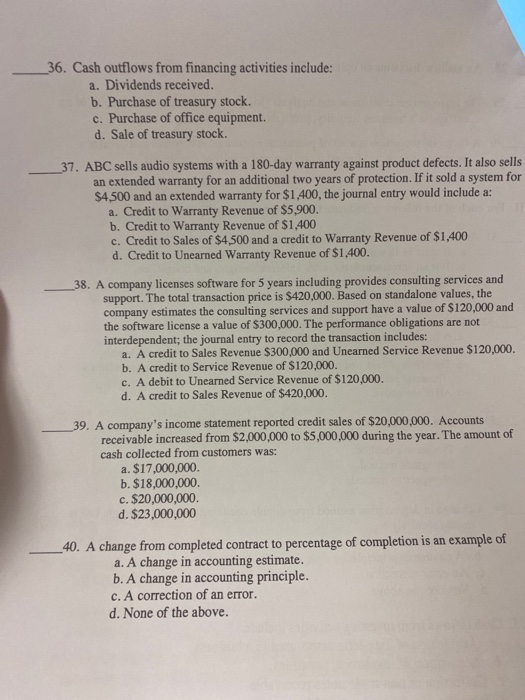

Question: 36. Cash outflows from financing activities include: a. Dividends received. b. Purchase of treasury stock. c. Purchase of office equipment. d. Sale of treasury stock.

36. Cash outflows from financing activities include: a. Dividends received. b. Purchase of treasury stock. c. Purchase of office equipment. d. Sale of treasury stock. ABC sells audio systems with a 180-day warranty against product defects. It also sells an extended warranty for an additional two years of protection. If it sold a system for $4,500 and an extended warranty for $1,400, the journal entry would inclu a. Credit to Warranty Revenue of $5,900. b. Credit to Warranty Revenue of $1,400 c. Credit to Sales of $4,500 and a credit to Warranty Revenue of $1,400 d. Credit to Unearned Warranty Revenue of $1.400. 38. A company licenses software for 5 years including provides consulting services and support. The total transaction price is $420,000. Based on standalone values, the company estimates the consulting services and support have a value of $120,000 and the software license a value of $300,000. The performance obligations are not interdependent; the journal entry to record the transaction includes: a. A credit to Sales Revenue $300,000 and Unearned Service Revenue $120,000 b. A credit to Service Revenue of $120,000. c. A debit to Unearned Service Revenue of $120,000. d. A credit to Sales Revenue of $420,000. _39. A company's income statement reported credit sales of $20,000,000. Accounts receivable increased from $2,000,000 to $5,000,000 during the year. The amount of cash collected from customers was: a. $17,000,000. b. $18,000,000 c. $20,000,000 d. $23,000,000 40. A change from completed contract to percentage of completion is an example of a. A change in accounting estimate. b. A change in accounting principle. c. A correction of an error. d. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts