Question: 37 37. (8 points) The manager of the processing division of XYZ Corporation is considering the purchase of new equipment. The division currently has assets

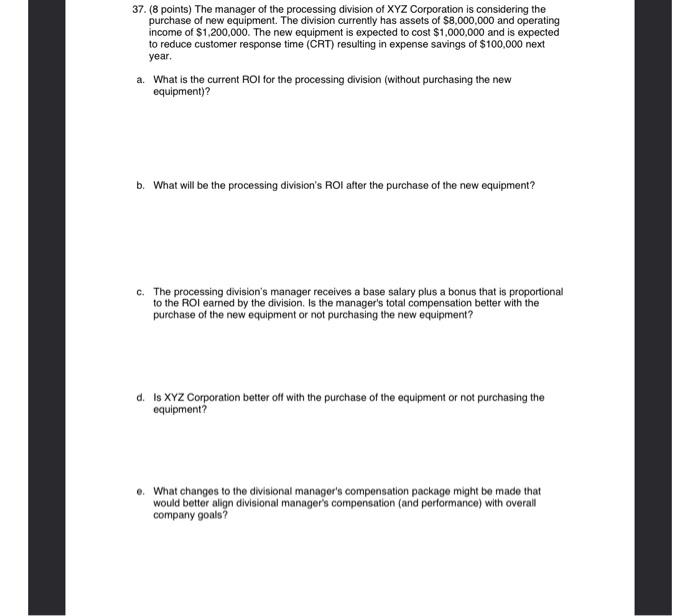

37. (8 points) The manager of the processing division of XYZ Corporation is considering the purchase of new equipment. The division currently has assets of $8,000,000 and operating income of $1,200,000. The new equipment is expected to cost $1,000,000 and is expected to reduce customer response time (CRT) resulting in expense savings of $100,000 next year. a. What is the current ROI for the processing division (without purchasing the new equipment)? b. What will be the processing division's ROI after the purchase of the new equipment? c. The processing division's manager receives a base salary plus a bonus that is proportional to the ROI earned by the division. Is the manager's total compensation better with the purchase of the new equipment or not purchasing the new equipment? d. Is XYZ Corporation better off with the purchase of the equipment or not purchasing the equipment? e. What changes to the divisional manager's compensation package might be made that would better align divisional manager's compensation (and performance) with overall company goals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts