Question: 37 38 24 37. Because some analysts caution that it is possible that macroeconomic condition may continue to decline in the next five years, Jay's

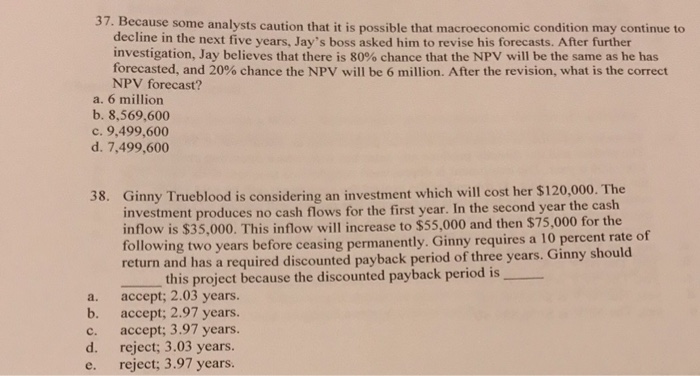

37. Because some analysts caution that it is possible that macroeconomic condition may continue to decline in the next five years, Jay's boss asked him to revise his forecasts. After further investigation, Jay believes that there is 80% chance that the NPv will be the same as he has forecasted, and 20% chance the NPv will be 6 million. After the revision, what is the correct NPV forecast? a. 6 million b. 8,569,600 c. 9,499,600 d. 7,499,600 38. considering an investment which will cost her $120,000. The nvestment produces no cash flows for the first year. In the second year the cash inflow is $35,000. This inflow will increase to $55,000 and then $75,000 for the of following two years before ceasing permanently. Ginny requires a 10 percent rate return and has a required discounted payback period of three years. Ginny should this project because the discounted payback period is a. accept; 2.03 years. b. accept; 2.97 years c. accept; 3.97 years. d. reject; 3.03 years. e. reject; 3.97 years. 37. Because some analysts caution that it is possible that macroeconomic condition may continue to decline in the next five years, Jay's boss asked him to revise his forecasts. After further investigation, Jay believes that there is 80% chance that the NPv will be the same as he has forecasted, and 20% chance the NPv will be 6 million. After the revision, what is the correct NPV forecast? a. 6 million b. 8,569,600 c. 9,499,600 d. 7,499,600 38. considering an investment which will cost her $120,000. The nvestment produces no cash flows for the first year. In the second year the cash inflow is $35,000. This inflow will increase to $55,000 and then $75,000 for the of following two years before ceasing permanently. Ginny requires a 10 percent rate return and has a required discounted payback period of three years. Ginny should this project because the discounted payback period is a. accept; 2.03 years. b. accept; 2.97 years c. accept; 3.97 years. d. reject; 3.03 years. e. reject; 3.97 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts