Question: 37. a. Return to Example 16.1. Use the binomial model to value a one-year European put option with exercise price $110 on the stock in

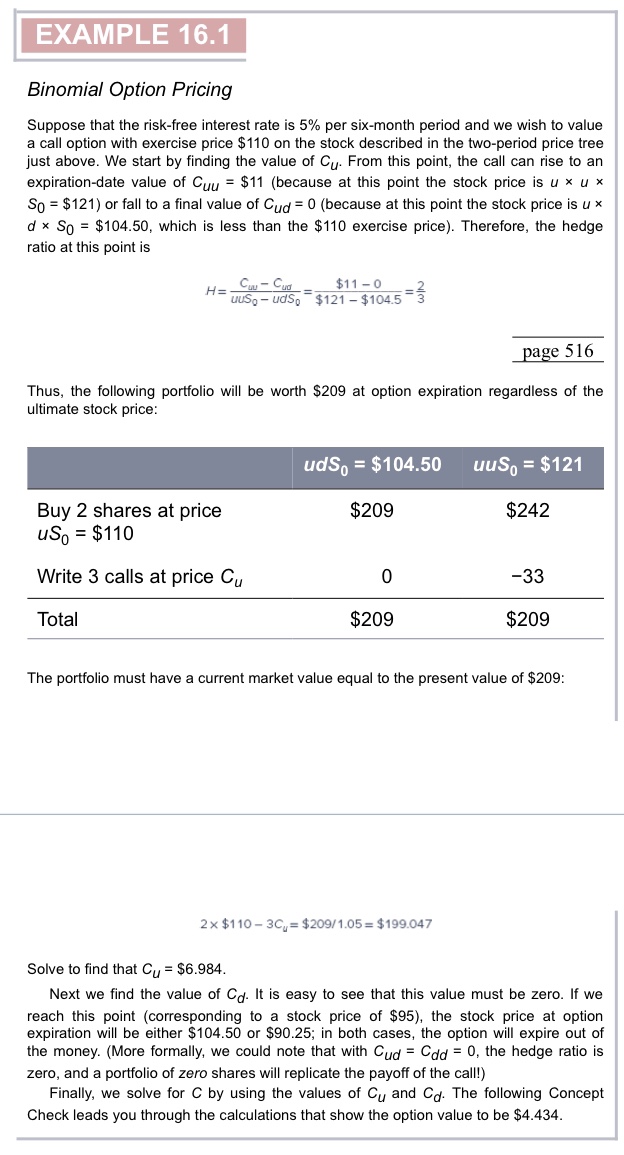

37. a. Return to Example 16.1. Use the binomial model to value a one-year European put option with exercise price $110 on the stock in that example. b. Show that your solution for the put price satisfies put-call parity. (LO 16-2) Bnomial Opton Prcng Suppose that the risk-free interest rate is 5% per six-month period and we wish to value a call option with exercise price $110 on the stock described in the two-period price tree just above. We start by finding the value of Cu. From this point, the call can rise to an expiration-date value of Cuu=$11 (because at this point the stock price is uu S0=$121 ) or fall to a final value of Cud=0 (because at this point the stock price is u dS0=$104.50, which is less than the $110 exercise price). Therefore, the hedge ratio at this point is H=uuS0udS0CuvCud=$121$104.5$110=32 page 516 Thus, the following portfolio will be worth $209 at option expiration regardless of the ultimate stock price: The portfolio must have a current market value equal to the present value of $209 : 2$1103Cu=$209/1.05=$199.047 Solve to find that CU=$6.984. Next we find the value of Cd. It is easy to see that this value must be zero. If we reach this point (corresponding to a stock price of \$95), the stock price at option expiration will be either $104.50 or $90.25; in both cases, the option will expire out of the money. (More formally, we could note that with Cud=Cdd=0, the hedge ratio is zero, and a portfolio of zero shares will replicate the payoff of the call!) Finally, we solve for C by using the values of CU and Cd. The following Concept Check leads you through the calculations that show the option value to be $4.434

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts