Question: 37. Interpreting footnote for restructuring accrual and effect on Goodwill computation In 2014, Perrigo Company, plc acquired Elan Corporation, plc for approximately $9.5 billion. As

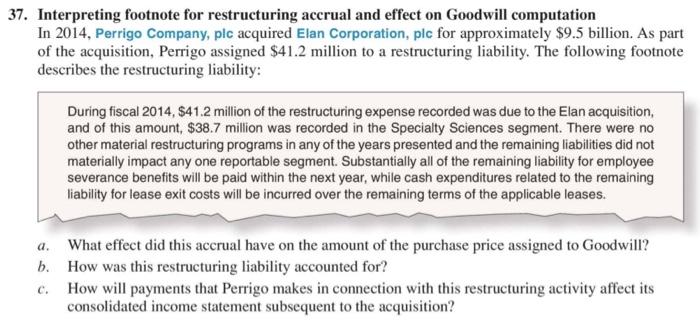

37. Interpreting footnote for restructuring accrual and effect on Goodwill computation In 2014, Perrigo Company, plc acquired Elan Corporation, plc for approximately $9.5 billion. As part of the acquisition, Perrigo assigned $41.2 million to a restructuring liability. The following footnote describes the restructuring liability: During fiscal 2014, $41.2 million of the restructuring expense recorded was due to the Elan acquisition, and of this amount, $38.7 million was recorded in the Specialty Sciences segment. There were no other material restructuring programs in any of the years presented and the remaining liabilities did not materially impact any one reportable segment. Substantially all of the remaining liability for employee severance benefits will be paid within the next year, while cash expenditures related to the remaining liability for lease exit costs will be incurred over the remaining terms of the applicable leases. a. What effect did this accrual have on the amount of the purchase price assigned to Goodwill? b. How was this restructuring liability accounted for? How will payments that Perrigo makes in connection with this restructuring activity affect its consolidated income statement subsequent to the acquisition? C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts