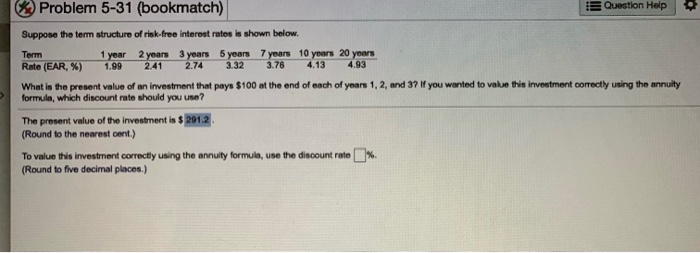

Question: 3.76 Problem 5-31 (bookmatch) Question Help Suppose the term structure of risk-free interest rates is shown below. Term 1 year 2 years 3 years 5

3.76 Problem 5-31 (bookmatch) Question Help Suppose the term structure of risk-free interest rates is shown below. Term 1 year 2 years 3 years 5 years 7 years 10 years 20 years Rate (EAR, %) 1.99 2.41 2.74 3.32 4.13 4.93 What is the present value of an investment that pays $100 at the end of each of years 1, 2, and 37 If you wanted to value this investment correctly using the annuity formule, which discount rate should you use? The present value of the investment is $ 291.2 (Round to the nearest cent.) To value this investment correctly using the annuity formula, use the discount rate % (Round to five decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts