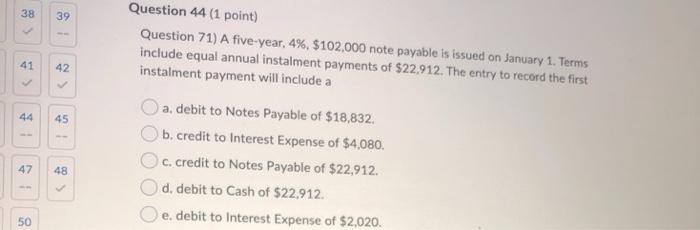

Question: 38 39 Question 44 (1 point) Question 71) A five-year, 4%, $102,000 note payable is issued on January 1. Terms include equal annual instalment payments

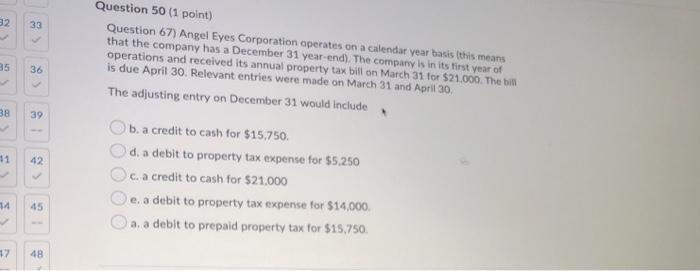

38 39 Question 44 (1 point) Question 71) A five-year, 4%, $102,000 note payable is issued on January 1. Terms include equal annual instalment payments of $22.912. The entry to record the first instalment payment will include a 41 42 44 45 a. debit to Notes Payable of $18,832. b. credit to Interest Expense of $4,080. C. credit to Notes Payable of $22,912. d. debit to Cash of $22,912. e. debit to Interest Expense of $2,020 47 48 50 32 33 Question 50 (1 point) Question 67) Angel Eyes Corporation operates on a calendar year basis this means that the company has a December 31 year-end). The company is in its first year of operations and received its annual property tax bill on March 31 for $21.000. The bil is due April 30. Relevant entries were made on March 31 and April 30 The adjusting entry on December 31 would include 35 36 38 39 11 42 b. a credit to cash for $15,750 d. a debit to property tax expense for $5,250 c. a credit to cash for $21,000 e. a debit to property tax expense for $14,000 O a. a debit to prepaid property tax for $15,750 14 45 17 48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts