Question: 38) Same information as before - you start your business on January 1st. Your sales are forecasted to be $125,000 for January, $140,000 for February,

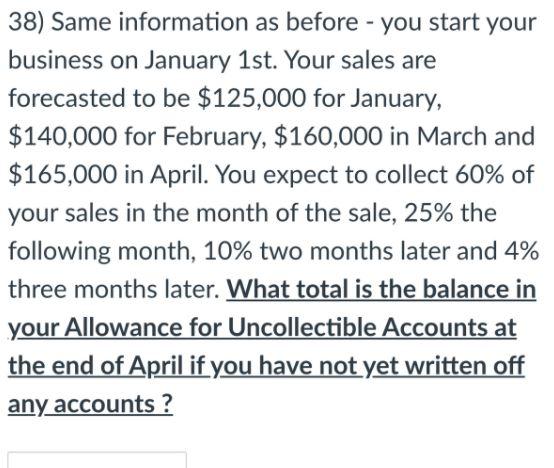

38) Same information as before - you start your business on January 1st. Your sales are forecasted to be $125,000 for January, $140,000 for February, $160,000 in March and $165,000 in April. You expect to collect 60% of your sales in the month of the sale, 25% the following month, 10% two months later and 4% three months later. What total is the balance in your Allowance for Uncollectible Accounts at the end of April if you have not yet written off any accounts ? 38) Same information as before - you start your business on January 1st. Your sales are forecasted to be $125,000 for January, $140,000 for February, $160,000 in March and $165,000 in April. You expect to collect 60% of your sales in the month of the sale, 25% the following month, 10% two months later and 4% three months later. What total is the balance in your Allowance for Uncollectible Accounts at the end of April if you have not yet written off any accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts