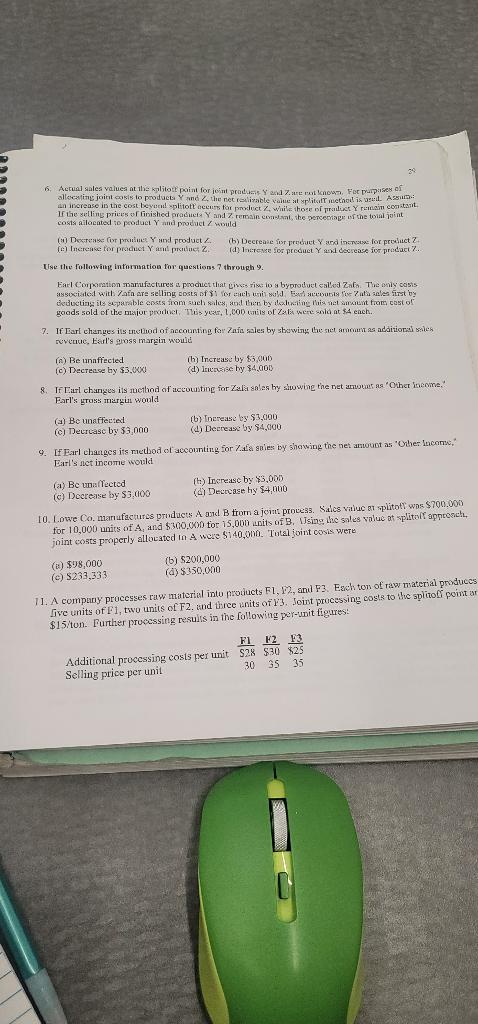

Question: 39 6. Actual sales values at the abito point for joint prey Zac rown, yo pupies of locating jollcosis to producte nec resinable wale walitatieteiliul

39 6. Actual sales values at the abito point for joint prey Zac rown, yo pupies of locating jollcosis to producte nec resinable wale walitatieteiliul an increase in the cost beyond litott occurs for product wille Shore of Trade Y rewal constant If the selling prices of finished product: Y and remain at the percentage of the total joint costs allocated to product Y and product Z would (3) Decerpret Yand product (b) Decrease for product and in for product Z (c) Increase for prachut Y and price Z (d) Ineren for product Y and decrease for product 7. Use the following information for questions through 9. Earl Corporation manufactures product that Livestilo byproduct called Za The only costs associated with Zafn are selling costs of $1 to esclusivaldis Zatles first by deducting its sparable costs from such sales and then by clicking huis net runt from cost of goods sold of the major productos year, 1,00D Canis ol zal were sold at $4 ench 7. If Earl changes its thethod of accounting for Zaic sales by showing the start as additional mes RUVCU, Earl's gross margin would (A) Be unaffected ih) Increase by $5,000 (c) Decrease by $3.XXI (d) selvy $4.000 8. Tr Farl changes ils aucthod of accounting for Zalla antes by showing the net aroma 'Other love! Farl's TOSS mergin would (a) Be unaffected (c) Decreasc by 33.000 (b) Increase by $3.000 (d) Decrease by $4.000 9. If Earl changes its method of accounting for a snles by showing the ne atout as 'Other Income Earl's nct income would (a) Be unaffected (c) Dcore by $3.000 (b) Increasc by $5.000 (d) Decrcase hy $4.000 10. Lowe Co manufactures products A and B from a joint provers. Salcs value et splitof wos $700.000 for 10,000 units of A, and $300,000 tor 15,000 units of 3. Jsing the sales value of splito approach, joint costs properly allocated in A were $140,000. Total joint costs were () $98,000 (c) 5233 333 (b) $200,000 (d) $350.00 11. A company processes raw material into products F1, 12, anul 3. Esch ton of raw material produces five units of F1, two units of F2. and three units of Y3. Soint processing costs to the splitoff point ar $15/ton. Further processing results in the following per-unit figures: F1 F2 F3 Additional processing costs per unit S28 $30 $25 Selling price per unit 30 35 35 39 6. Actual sales values at the abito point for joint prey Zac rown, yo pupies of locating jollcosis to producte nec resinable wale walitatieteiliul an increase in the cost beyond litott occurs for product wille Shore of Trade Y rewal constant If the selling prices of finished product: Y and remain at the percentage of the total joint costs allocated to product Y and product Z would (3) Decerpret Yand product (b) Decrease for product and in for product Z (c) Increase for prachut Y and price Z (d) Ineren for product Y and decrease for product 7. Use the following information for questions through 9. Earl Corporation manufactures product that Livestilo byproduct called Za The only costs associated with Zafn are selling costs of $1 to esclusivaldis Zatles first by deducting its sparable costs from such sales and then by clicking huis net runt from cost of goods sold of the major productos year, 1,00D Canis ol zal were sold at $4 ench 7. If Earl changes its thethod of accounting for Zaic sales by showing the start as additional mes RUVCU, Earl's gross margin would (A) Be unaffected ih) Increase by $5,000 (c) Decrease by $3.XXI (d) selvy $4.000 8. Tr Farl changes ils aucthod of accounting for Zalla antes by showing the net aroma 'Other love! Farl's TOSS mergin would (a) Be unaffected (c) Decreasc by 33.000 (b) Increase by $3.000 (d) Decrease by $4.000 9. If Earl changes its method of accounting for a snles by showing the ne atout as 'Other Income Earl's nct income would (a) Be unaffected (c) Dcore by $3.000 (b) Increasc by $5.000 (d) Decrcase hy $4.000 10. Lowe Co manufactures products A and B from a joint provers. Salcs value et splitof wos $700.000 for 10,000 units of A, and $300,000 tor 15,000 units of 3. Jsing the sales value of splito approach, joint costs properly allocated in A were $140,000. Total joint costs were () $98,000 (c) 5233 333 (b) $200,000 (d) $350.00 11. A company processes raw material into products F1, 12, anul 3. Esch ton of raw material produces five units of F1, two units of F2. and three units of Y3. Soint processing costs to the splitoff point ar $15/ton. Further processing results in the following per-unit figures: F1 F2 F3 Additional processing costs per unit S28 $30 $25 Selling price per unit 30 35 35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts