Question: 39) A company's controller estimated bad debt expense using the percentage of accounts receivable method. Total sales for the year were $500,000. The ending

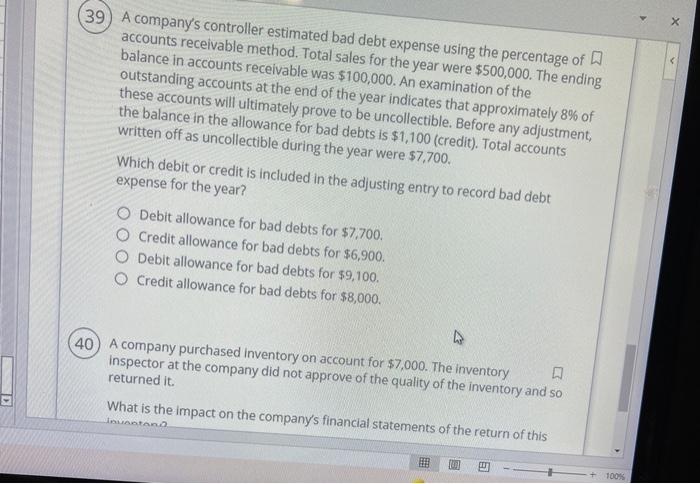

39) A company's controller estimated bad debt expense using the percentage of accounts receivable method. Total sales for the year were $500,000. The ending balance in accounts receivable was $100,000. An examination of the outstanding accounts at the end of the year indicates that approximately 8% of these accounts will ultimately prove to be uncollectible. Before any adjustment, the balance in the allowance for bad debts is $1,100 (credit). Total accounts written off as uncollectible during the year were $7,700. Which debit or credit is included in the adjusting entry to record bad debt expense for the year? O Debit allowance for bad debts for $7,700. O Credit allowance for bad debts for $6,900. Debit allowance for bad debts for $9,100. O Credit allowance for bad debts for $8,000. L (40) A company purchased inventory on account for $7,000. The inventory inspector at the company did not approve of the quality of the inventory and so returned it. What is the impact on the company's financial statements of the return of this Jouentand 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts