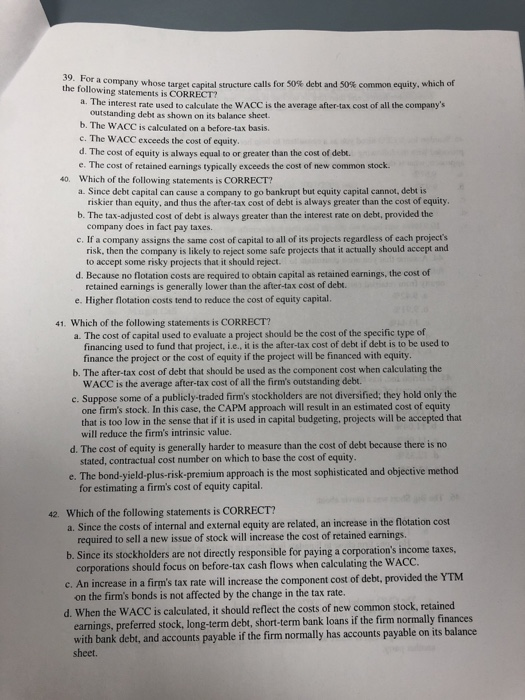

Question: 39. For a company whose target capital structure calls for 50% debt and 50% common equity, which of a. The interest rate used to calculate

39. For a company whose target capital structure calls for 50% debt and 50% common equity, which of a. The interest rate used to calculate the WACC is the average after-tax cost of all the company's outstanding debt as shown on its balance sheet. b. The WACC is calculated on a before-tax basis. c. The WACC exceeds the cost of equity. d. The cost of equity is always equal to or greater than the cost of debt. e. The cost of retained earnings typically exceeds the cost of new common stock Which of the following statements is CORRECT? a. Since debt capital can cause a company to go bankrupt but equity capital cannot, debt is riskier than equity, and thus the after-tax cost of debt is always greater than the cost of equity b. The tax-adjusted cost of debt is always greater than the interest rate on debt, provided the company does in fact pay taxes. 40. c. If a company assigns the same cost of capital to all of its projects regardless of cach project's risk, then the company is likely to reject some safe projects that it actually should accept and to accept some risky projects that it should reject. d. Because no flotation costs are required to obtain capital as retained earnings, the cost of retained earnings is generally lower than the after-tax cost of debt. e. Higher flotation costs tend to reduce the cost of equity capital 41. Which of the following statements is CORRECT? a. The cost of capital used to evaluate a project should be the cost of the specific type of financing used to fund that project, i.e., it is the after-tax cost of debt if debt is to be used to finance the project or the cost of equity if the project will be financed with equity b. The after-tax cost of debt that should be used as the component cost when calculating the WACC is the average after-tax cost of all the firm's outstanding debt. c. Suppose some of a publicly-traded firm's stockholders are not diversified; they hold only the one firm's stock. In this case, the CAPM approach will result in an estimated cost of equity that is too low in the sense that if it is used in capital budgeting, projects will be accepted that will reduce the firm's intrinsic value. d. The cost of equity is generally harder to measure than the cost of debt because there is no stated, contractual cost number on which to base the cost of equity e. The bond-yield-plus-risk-premium approach is the most sophisticated and objective method for estimating a firm's cost of equity capital. 42. Which of the following statements is CORRECT? a. Since the costs of internal and external equity are related, an increase in the flotation cost required to sell a new issue of stock will increase the cost of retained earnings. b. Since its stockholders are not directly responsible for paying a corporation's income taxes, corporations should focus on before-tax cash flows when calculating the WACC. c. An increase in a firm's tax rate will increase the component cost of debt, provided the YTM on the firm's bonds is not affected by the change in the tax rate. d. When the WACC is calculated, it should reflect the costs of new common stock, retained earnings, preferred stock, long-term debt, short-term bank loans if the firm normally finances with bank debt, and accounts payable if the firm normally has accounts payable on its balance sheet. e. If a firm has been suffering accounting losses tht are expected to continue into the foreseeable future, and therefore its tax rate is zero, then it is possible for the after-tax cost of preferred stock to be less than the after-tax cost of debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts