Question: 39. No par value shares give a * 1 point more realistic value when they are exchanged for assets. 40. For income tax purposes, *

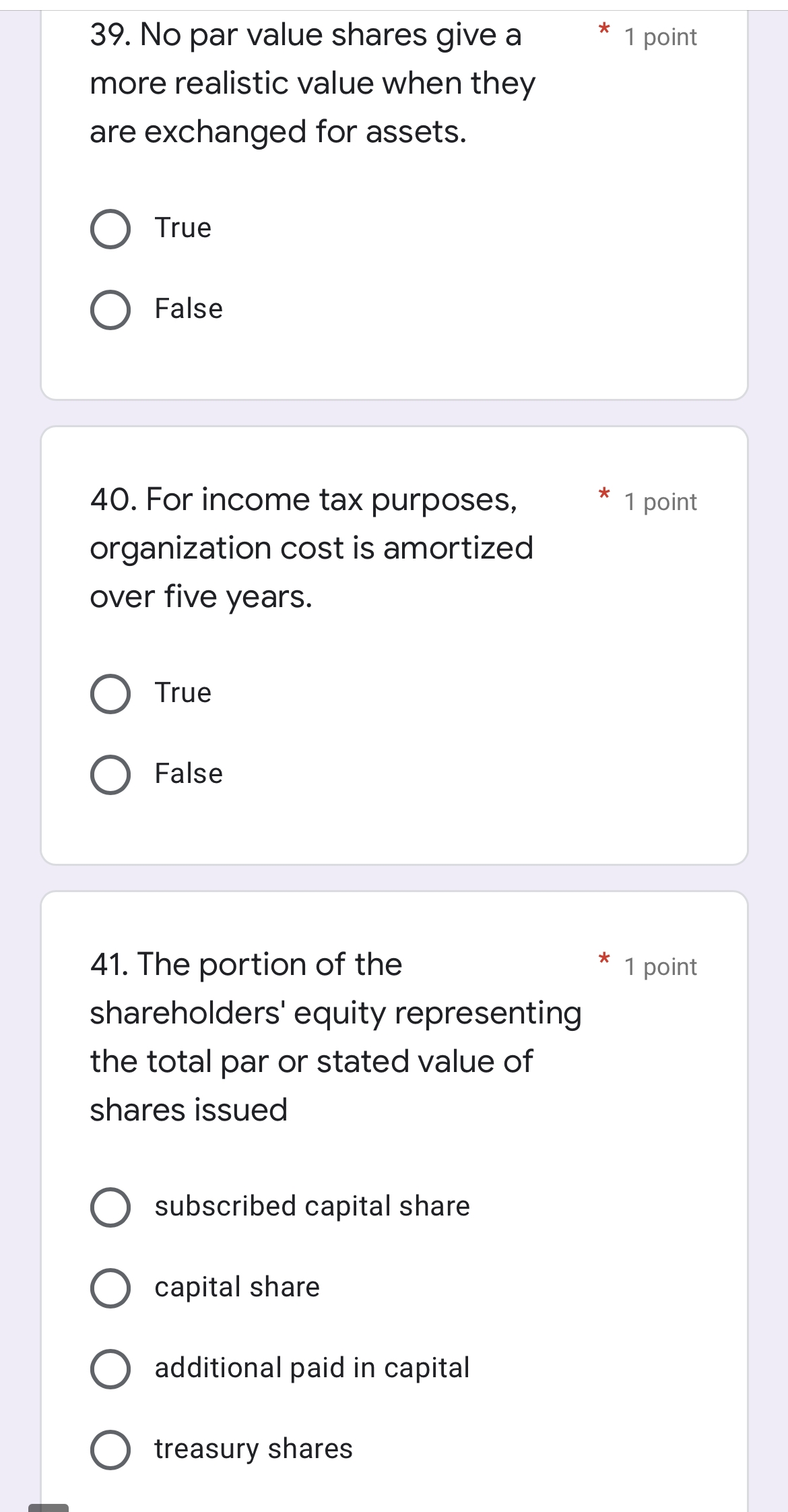

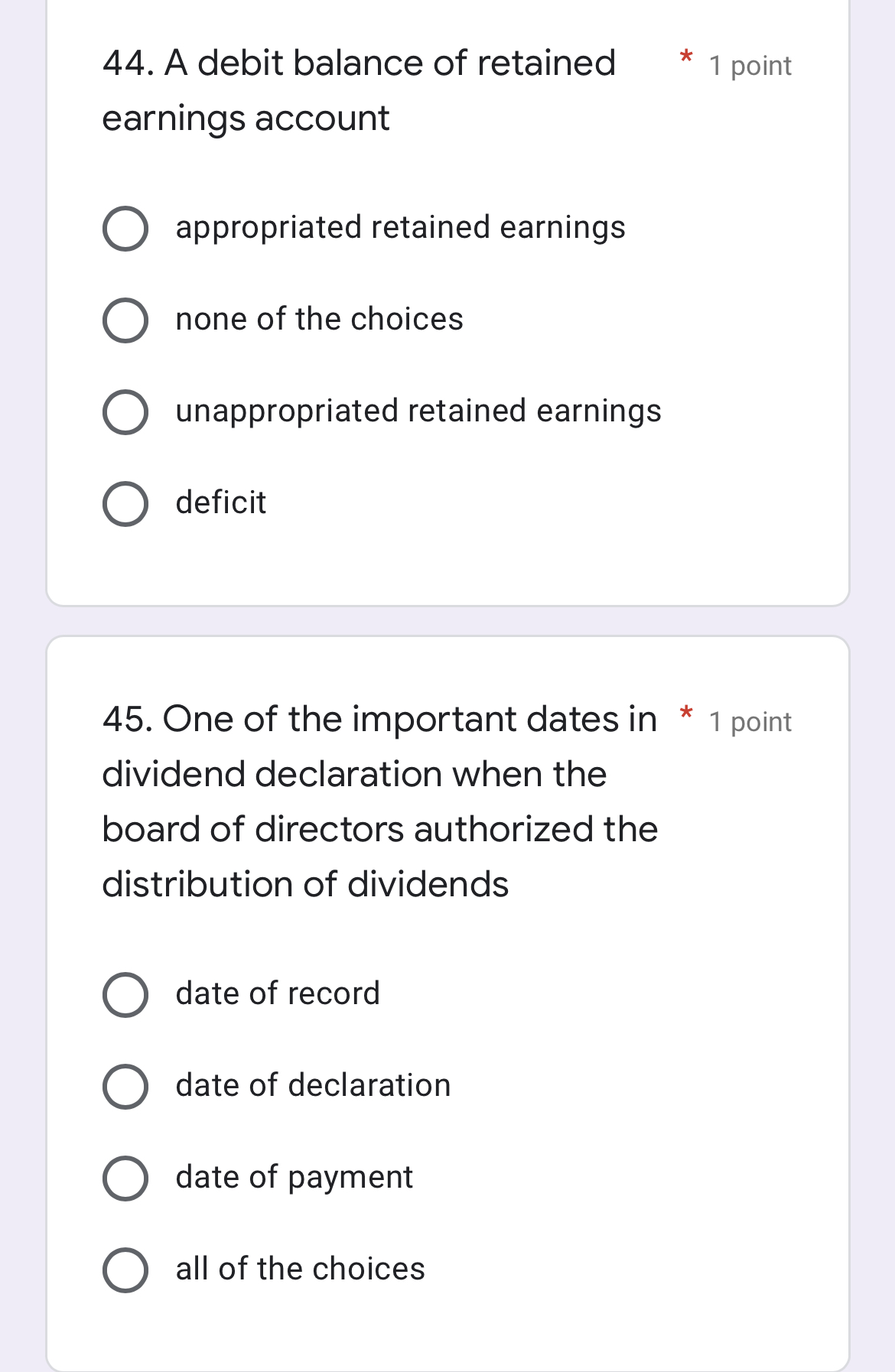

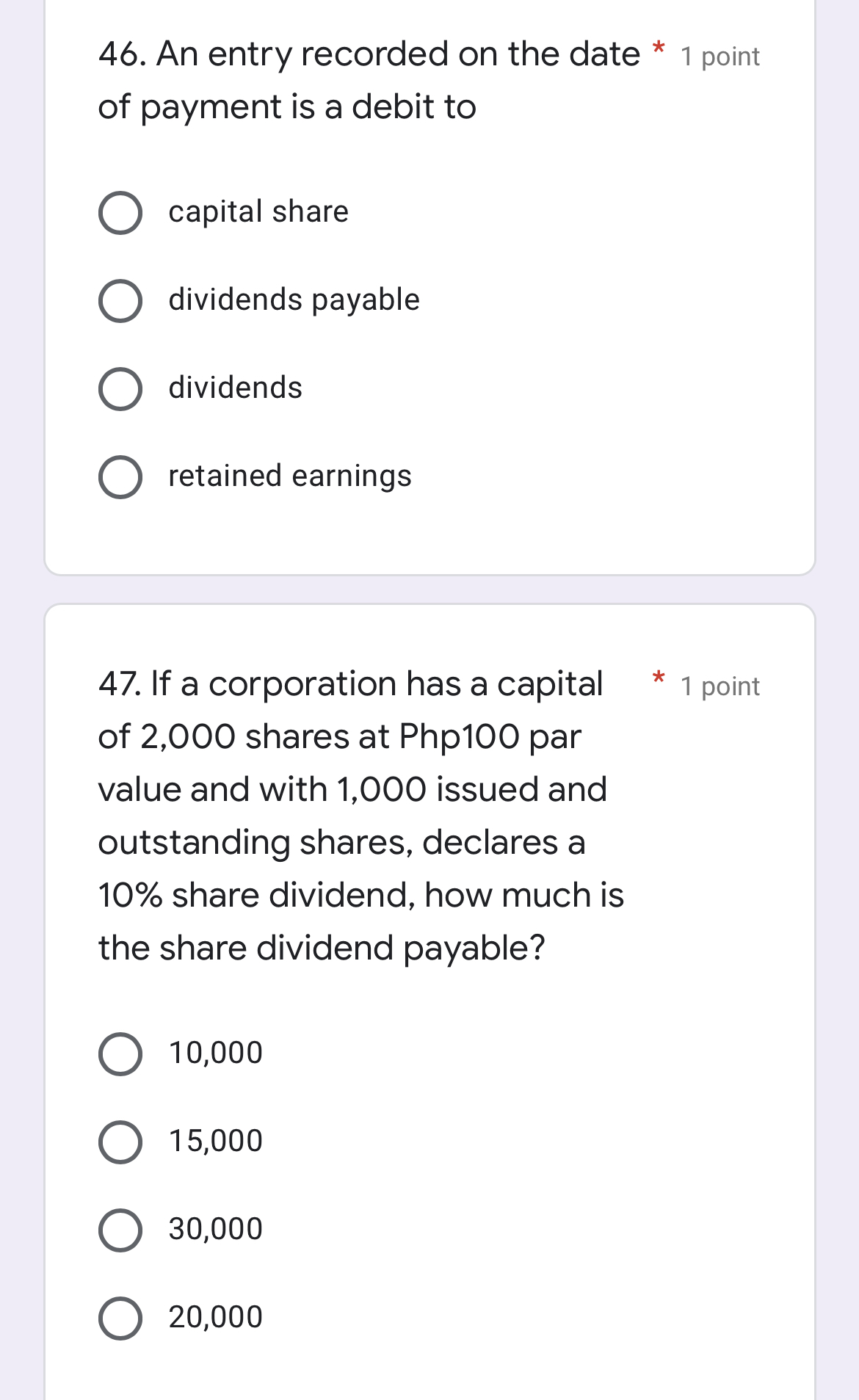

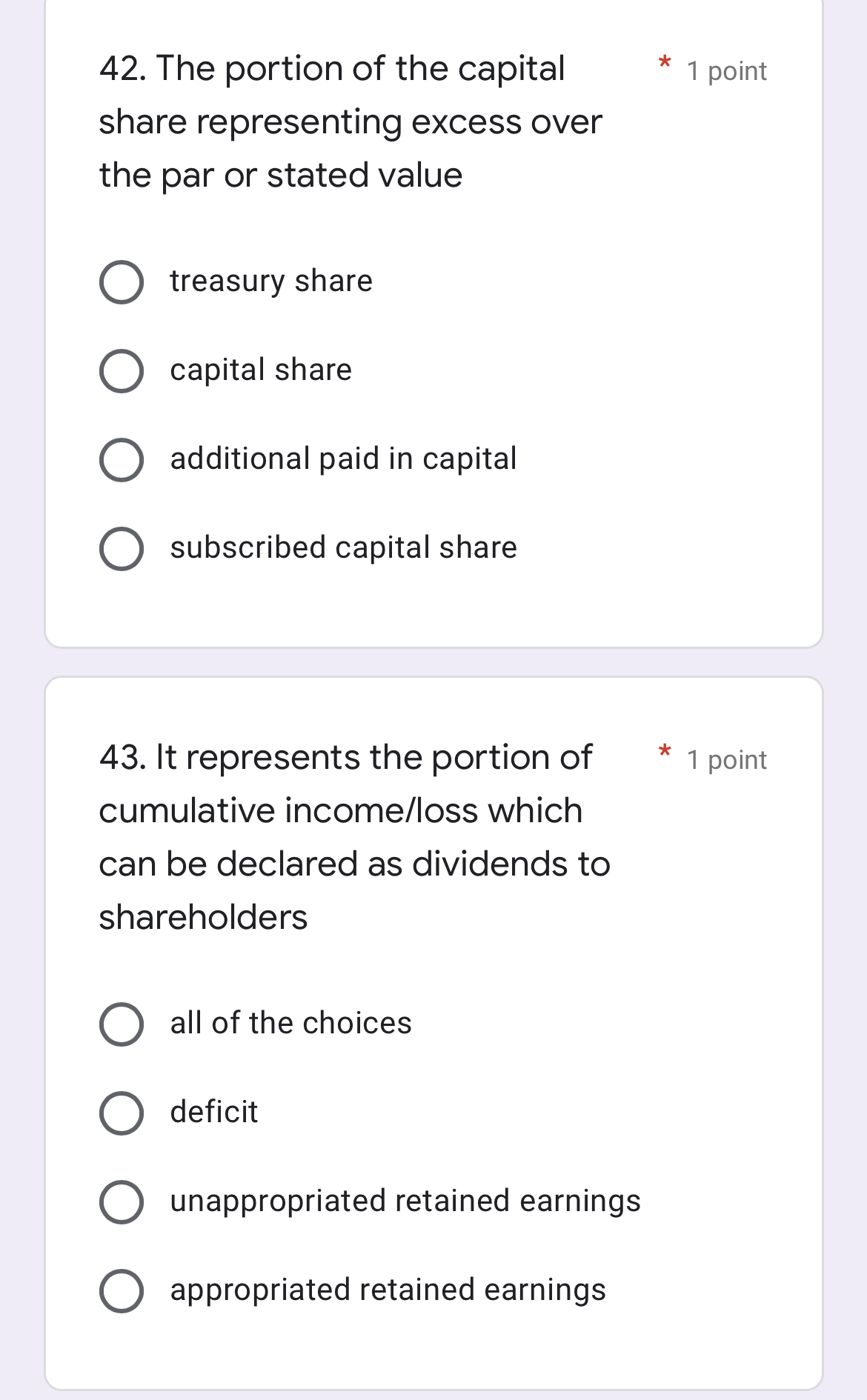

39. No par value shares give a * 1 point more realistic value when they are exchanged for assets. 40. For income tax purposes, * 1 point organization cost is amortized over five years. 41. The portion of the * 1 point shareholders' equity representing the total par or stated value of shares issued 0 subscribed capital share 0 capital share 0 additional paid in capital 0 treasury shares 44. A debit balance of retained * 1 point earnings account 0 appropriated retained earnings 0 none of the choices 0 unappropriated retained earnings 0 deficit 45. One of the important dates in * 1 point dividend declaration when the board of directors authorized the distribution of dividends 0 date of record 0 date of declaration 0 date of payment 0 all of the choices 46. An entry recorded on the date * 1 point of payment is a debit to 0 capital share 0 dividends payable 0 dividends O retained earnings 47. If a corporation has a capital * 1 point of 2,000 shares at Php100 par value and with 1,000 issued and outstanding shares, declares a 10% share dividend, how much is the share dividend payable? 42. The portion of the capital share representing excess over the par or stated value 0 treasury share 0 capital share 0 additional paid in capital 0 subscribed capital share 43. It represents the portion of cumulative income/loss which can be declared as dividends to shareholders 0 all of the choices deficit unappropriated retained earnings OOO appropriated retained earnings * 1 point * 1 point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts