Question: 3(a) Advertisements suggest that a new window design can save $400 per year in energy cost over its 30-year life. At an initial cost of

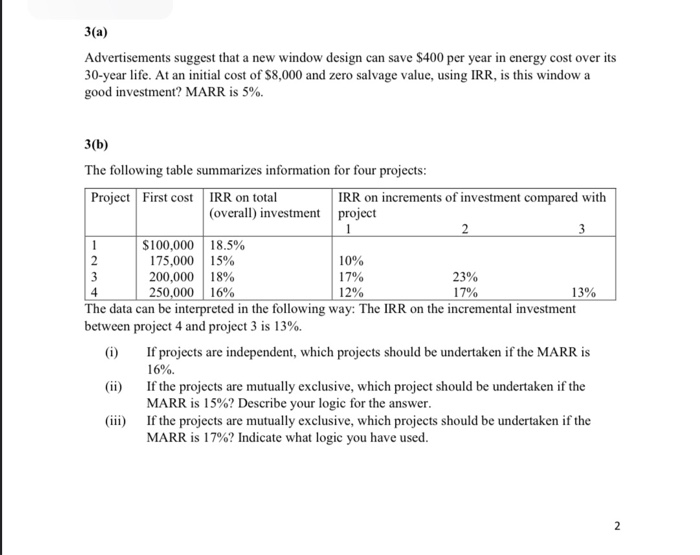

3(a) Advertisements suggest that a new window design can save $400 per year in energy cost over its 30-year life. At an initial cost of $8,000 and zero salvage value, using IRR, is this window a good investment? MARR is 5%. 3(b) The following table summarizes information for four projects: Project First cost IRR on total IRR on increments of investment compared with (overall) investment project 7% 17% $100,000 18.5% 175,000 15% 10% 200,000 18% 23% 250,000 16% 13% The data can be interpreted in the following way: The IRR on the incremental investment between project 4 and project 3 is 13%. (1) If projects are independent, which projects should be undertaken if the MARR is 16%. (ii) If the projects are mutually exclusive, which project should be undertaken if the MARR is 15%? Describe your logic for the answer. (iii) If the projects are mutually exclusive, which projects should be undertaken if the MARR is 17%? Indicate what logic you have used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts