Question: 3A and 4A Net Present Value, Cash Payback, and Average Kate of Return Methods Western Company is luting a possible $42,000 investment in special tools

3A and 4A

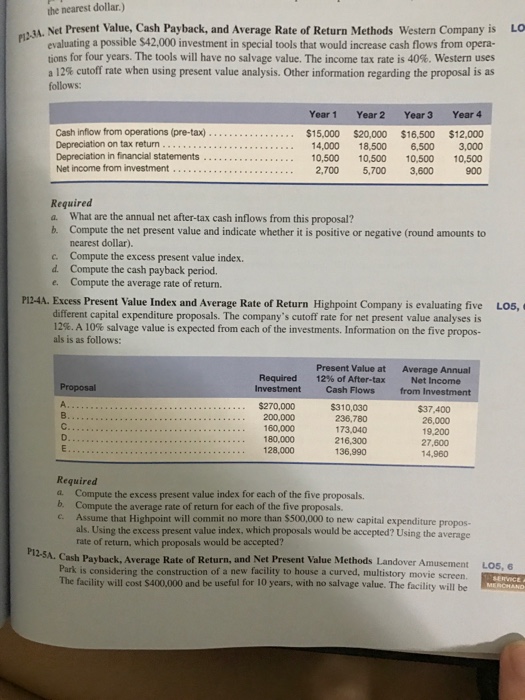

3A and 4A Net Present Value, Cash Payback, and Average Kate of Return Methods Western Company is luting a possible $42,000 investment in special tools that would increase cash flows from operations for four years. The tools will have no salvage value. The income tax rate is 40%. Western uses s 12% cutoff rate when using present value analysis. Other information regarding the proposal is as follow. Required a. What are the annual net after-tax cash inflows from this proposal? b. Compute the net present value and indicate whether it is positive or negative (round amounts to nearest dollar). c. Compute the excess present value index. d. Compute the cash payback period. e. Compute the average rate of return. Excess Present Value Index and Average Rate of Return Highpoint Company is evaluating five L05, different capital expenditure proposals. The company's cutoff rate for net present value analyses is 12%. A 10% salvage value is expected from each of the investments. Information on the five proposals is as follows: Required a. Compute the excess present value index for each of the five proposals. b. Compute the average rate of return for each of the fix proposals. c. Assume that Highpoint will commit no more than $500,000 to new capital expenditure proposals. Using the excess present value index, which proposals would be accepted? Using the average rate of return, which proposals would be accepted? Cash Payback, Average Rate of Return, and Net Present Value Methods Landover Amusement Part is considering the construction of a new facility to house a cursed, multistory movie screen. The facility will cost $400,000 and be useful for 10 years, with no salvage value. The facility will be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts