Question: 3.c. Based on the model below, a researcher would like to check whether he can predict (a) the performance of the portfolio of manufacturing stocks

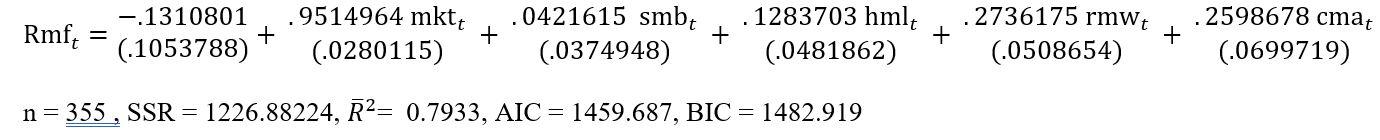

3.c. Based on the model below, a researcher would like to check whether he can predict (a) the performance of the portfolio of manufacturing stocks (Rmf) over the next three years, and (b) the performance of Rm f in the next month.

Advise the researcher on what types of uncertainty he ought to include in cases (a) and (b) when constructing his confidence intervals and why?

| mkt | Excess return on the market* | Risk factor associated with the overall market |

| smb | Small minus Big | Risk factor associated with the size of stocks |

| hml | High minus Low | Risk factor associated with the value of stocks |

| rmw | Robust minus Weak | Risk factor associated with the profitability of stocks |

| cma | Conservative minus Aggressive | Risk factor associated with the investment style of stocks |

| rf | Risk free interest rate | Risk free interest rate |

| Rmf | Excess return on the portfolio | Risk factor associated with the portfolio |

Rmfc -.1310801 + (.1053788) .9514964 mktt + 0.0280115) 0421615 smbt .1283703 hmlt + + (.0374948) (.0481862) 2736175 rmwt + (.0508654) 2598678 cmat (.0699719) n= 355 , SSR = 1226.88224, R2= 0.7933, AIC = 1459.687, BIC = 1482.919 Rmfc -.1310801 + (.1053788) .9514964 mktt + 0.0280115) 0421615 smbt .1283703 hmlt + + (.0374948) (.0481862) 2736175 rmwt + (.0508654) 2598678 cmat (.0699719) n= 355 , SSR = 1226.88224, R2= 0.7933, AIC = 1459.687, BIC = 1482.919

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts