Question: 3)Please answer with workings.. Tqvm Question 3 Norton Co, whose home currency is the New Zealand Dollar (NZD), trades regularly with customers and suppliers in

3)Please answer with workings.. Tqvm

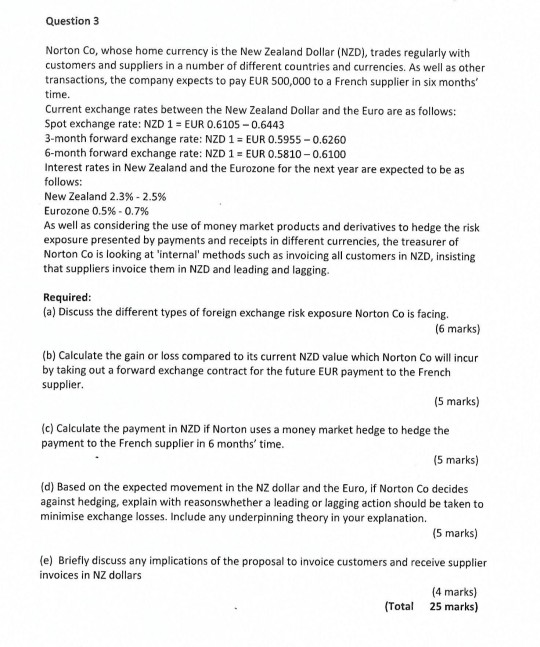

Question 3 Norton Co, whose home currency is the New Zealand Dollar (NZD), trades regularly with customers and suppliers in a number of different countries and currencies. As well as other transactions, the company expects to pay EUR 500,000 to a French supplier in six months time Current exchange rates between the New Zealand Dollar and the Euro are as follows: Spot exchange rate: NZD 1 - EUR 0.6105- 0.6443 3-month forward exchange rate: NZD 1 EUR 0.5955-0.6260 6-month forward exchange rate: NZD 1 EUR 0.5810-0.6100 Interest rates in New Zealand and the Eurozone for the next year are expected to be as follows: New Zealand 2.3 % - 2.5 % Eurozone 0.5% -0.7% As well as considering the use of money market products and derivatives to hedge the risk exposure presented by payments and receipts in different currencies, the treasurer of Norton Co is looking at 'internal' methods such as invoicing all customers in NZD, insisting that suppliers invoice them in NZD and leading and lagging. Required: (a) Discuss the different types of foreign exchange risk exposure Norton Co is facing. (6 marks) (b) Calculate the gain or loss compared to its current NZD value which Norton Co will incur by taking out a forward exchange contract for the future EUR payment to the French supplier (5 marks) (c) Calculate the payment in NZD if Norton uses a money market hedge to hedge the payment to the French supplier in 6 months' time. (5 marks) (d) Based on the expected movement in the NZ dollar and the Euro, if Norton Co decides against hedging, explain with reasonswhether a leading or lagging action should be taken to minimise exchange losses. Include any underpinning theory in your explanation. (5 marks) (e) Briefly discuss any implications of the proposal to invoice customers and receive supplier invoices in NZ dollars (4 marks) 25 marks) (Total Question 3 Norton Co, whose home currency is the New Zealand Dollar (NZD), trades regularly with customers and suppliers in a number of different countries and currencies. As well as other transactions, the company expects to pay EUR 500,000 to a French supplier in six months time Current exchange rates between the New Zealand Dollar and the Euro are as follows: Spot exchange rate: NZD 1 - EUR 0.6105- 0.6443 3-month forward exchange rate: NZD 1 EUR 0.5955-0.6260 6-month forward exchange rate: NZD 1 EUR 0.5810-0.6100 Interest rates in New Zealand and the Eurozone for the next year are expected to be as follows: New Zealand 2.3 % - 2.5 % Eurozone 0.5% -0.7% As well as considering the use of money market products and derivatives to hedge the risk exposure presented by payments and receipts in different currencies, the treasurer of Norton Co is looking at 'internal' methods such as invoicing all customers in NZD, insisting that suppliers invoice them in NZD and leading and lagging. Required: (a) Discuss the different types of foreign exchange risk exposure Norton Co is facing. (6 marks) (b) Calculate the gain or loss compared to its current NZD value which Norton Co will incur by taking out a forward exchange contract for the future EUR payment to the French supplier (5 marks) (c) Calculate the payment in NZD if Norton uses a money market hedge to hedge the payment to the French supplier in 6 months' time. (5 marks) (d) Based on the expected movement in the NZ dollar and the Euro, if Norton Co decides against hedging, explain with reasonswhether a leading or lagging action should be taken to minimise exchange losses. Include any underpinning theory in your explanation. (5 marks) (e) Briefly discuss any implications of the proposal to invoice customers and receive supplier invoices in NZ dollars (4 marks) 25 marks) (Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts