Question: 3.Project A pays out $2,000 (succeeds) with probability 1; it never fails. Project B pays out $3,000 (succeeds) with probability and pays 0 (fails) with

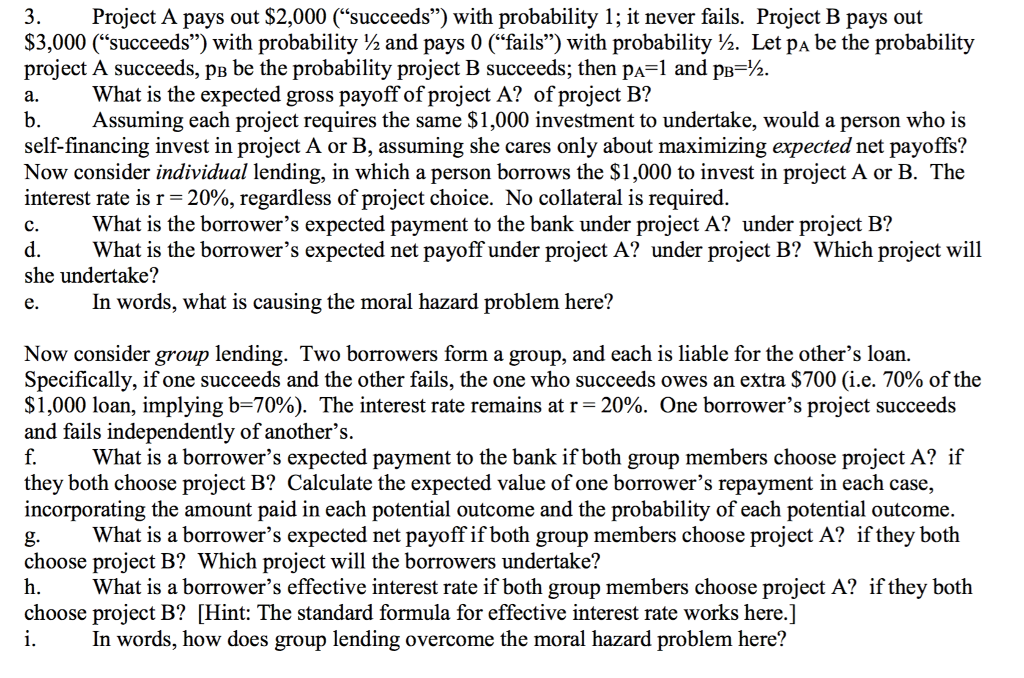

3.Project A pays out $2,000 ("succeeds") with probability 1; it never fails. Project B pays out $3,000 ("succeeds") with probability and pays 0 ("fails") with probability . Let PA be the probability project A succeeds, pB be the probability project B succeeds, then pA=1 and p %. What is the expected gross payoff of project A? of project B'? Assuming each project requires the same $1,000 investment to undertake, would a person who is self-financing invest in project A or B, assuming she cares only about maximizing expected net payoffs? Now consider individual lending, in which a person borrows the $1,000 to invest in project A or B. The interest rate is r 20%, regardless of project choice. No collateral is required. What is the borrower's expected payment to the bank under project A? under project B? What is the borrower's expected net payoff under project A? under project B? Which project will she undertake? e. In words, what is causing the moral hazard problem here? Now consider group lending. Two borrowers form a group, and each is liable for the other's loan. Specifically, if one succeeds and the other fails, the one who succeeds owes an extra $700 (ie, 70% of the $1,000 loan, implying b=70%). The interest rate remains at r= 20%. One borrower's project succeeds and fails independently of another's f. they both choose project B? Calculate the expected value of one borrower's repayment in each case, incorporating the amount paid in each potential outcome and the probability of each potential outcome. g. choose project B? Which project will the borrowers undertake? h. choose project B? [Hint: The standard formula for effective interest rate works here.] 1. What is a borrower's expected payment to the bank if both group members choose project A? if What is a borrower's expected net payoff if both group members choose project A? if they both What is a borrower's effective interest rate if both group members choose project A? if they both In words, how does group lending overcome the moral hazard problem here? 3.Project A pays out $2,000 ("succeeds") with probability 1; it never fails. Project B pays out $3,000 ("succeeds") with probability and pays 0 ("fails") with probability . Let PA be the probability project A succeeds, pB be the probability project B succeeds, then pA=1 and p %. What is the expected gross payoff of project A? of project B'? Assuming each project requires the same $1,000 investment to undertake, would a person who is self-financing invest in project A or B, assuming she cares only about maximizing expected net payoffs? Now consider individual lending, in which a person borrows the $1,000 to invest in project A or B. The interest rate is r 20%, regardless of project choice. No collateral is required. What is the borrower's expected payment to the bank under project A? under project B? What is the borrower's expected net payoff under project A? under project B? Which project will she undertake? e. In words, what is causing the moral hazard problem here? Now consider group lending. Two borrowers form a group, and each is liable for the other's loan. Specifically, if one succeeds and the other fails, the one who succeeds owes an extra $700 (ie, 70% of the $1,000 loan, implying b=70%). The interest rate remains at r= 20%. One borrower's project succeeds and fails independently of another's f. they both choose project B? Calculate the expected value of one borrower's repayment in each case, incorporating the amount paid in each potential outcome and the probability of each potential outcome. g. choose project B? Which project will the borrowers undertake? h. choose project B? [Hint: The standard formula for effective interest rate works here.] 1. What is a borrower's expected payment to the bank if both group members choose project A? if What is a borrower's expected net payoff if both group members choose project A? if they both What is a borrower's effective interest rate if both group members choose project A? if they both In words, how does group lending overcome the moral hazard problem here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts