Question: 3rd time posting #1 is not 4550.84 #3 is not 140000 1. Joe's salary is $2,500 every two weeks. His employer provides health insurance which

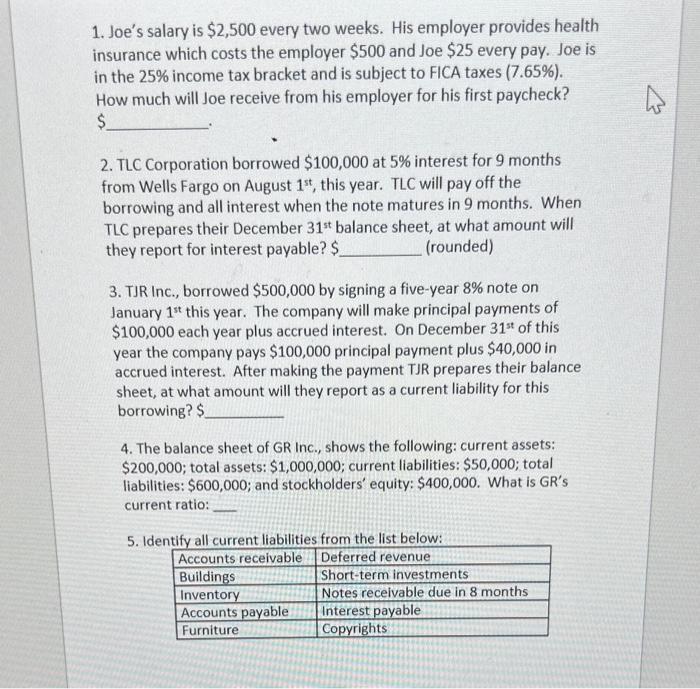

1. Joe's salary is $2,500 every two weeks. His employer provides health insurance which costs the employer $500 and Joe $25 every pay. Joe is in the 25% income tax bracket and is subject to FICA taxes (7.65\%). How much will Joe receive from his employer for his first paycheck? 2. TLC Corporation borrowed $100,000 at 5% interest for 9 months from Wells Fargo on August 1st, this year. TLC will pay off the borrowing and all interest when the note matures in 9 months. When TLC prepares their December 31st balance sheet, at what amount will they report for interest payable? \$ (rounded) 3. TJR Inc., borrowed $500,000 by signing a five-year 8% note on January 1st this year. The company will make principal payments of $100,000 each year plus accrued interest. On December 31st of this year the company pays $100,000 principal payment plus $40,000 in accrued interest. After making the payment TJR prepares their balance sheet, at what amount will they report as a current liability for this borrowing? \$ 4. The balance sheet of GR Inc., shows the following: current assets: $200,000; total assets: $1,000,000; current liabilities: $50,000; total liabilities: $600,000; and stockholders' equity: $400,000. What is GR s current ratio: 5. Identifu all rurrant liahilities from the list below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts