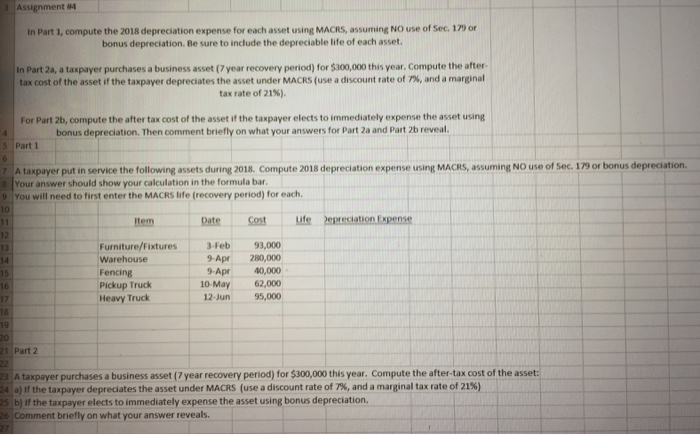

Question: 3TAssignment #4 In Part 1, compute the 2018 depreciation expense for each asset using MACRS, assuming NO use of Sec. 179 or bonus depreciation. Be

3TAssignment #4 In Part 1, compute the 2018 depreciation expense for each asset using MACRS, assuming NO use of Sec. 179 or bonus depreciation. Be sure to include the depreciable life of each asset. in Part 2a, a taxpayer purchases a business asset (7 year recovery period) for $300,000 this year. Compute the after tax cost of the asset if the taxpayer depreciates the asset under MACRS (use a discount rate of 7%, and a marginal tax rate of 21%). For Part 2b, compute the after tax cost of the asset if the taxpayer elects to immediately expense the asset using bonus depreciation. Then comment briefly on what your answers for Part 2a and Part 2b reveal Part 1 A taxpayer put in service the following assets during 2018, Compute 2018 depreciation expense using MACRS, assuming NO use of Sec. 179 or bonus depreciation. Your answer should show your calculation in the formula bar. o You will need to first enter the MACRS life (recovery period) for each. Item 12 Furniture/Fixtures Warehouse Fencing Pickup Truck Heavy Truck 3-Feb93,000 9-Apr 280,000 9-Apr 40,000 0-May62,000 12-Jun 95,000 16 18 21 Part 2 3 A taxpayer purchases a business asset (7 year recovery period) for $300,000 this year. Compute the after-tax cost of the asset 4.) If the taxpayer depreciates the asset under MACRS (use a discount rate of 7%, and a marginal tax rate of 21%) 5 b) If the taxpayer elects to immediately expense the asset using bonus depreciation. Comment briefly on what your answer reveals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts