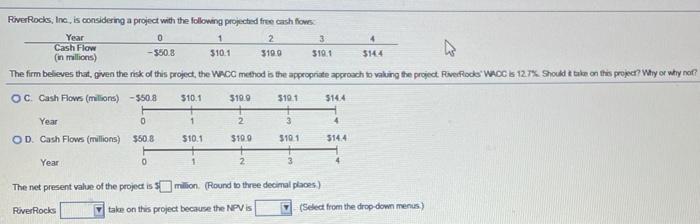

Question: 4 0 - $50.8 2 3199 3 310.1 River Rocks, Inc., is considering a project with the following projected free cash flows. Year Cash Flow

4 0 - $50.8 2 3199 3 310.1 River Rocks, Inc., is considering a project with the following projected free cash flows. Year Cash Flow 5144 (in Millions) The firm believes that, given the risk of this project, the WACC method is the appropriate approach to vaking the project Powerflods WAOC 12.7% Should it take on this project? Why or why not? OC Cash Flows (milions) -$508 5144 310.1 310.1 $10.0 $19.1 Year 0 1 2. 3 4 OD. Cash Flows (millions) $508 $10.1 $100 3101 5144 Year 0 1 2 3 The net present value of the project is smilton (Round to three decimal places) River Rocks V take on this project because the NPV is (Select from the drop-down menus)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock