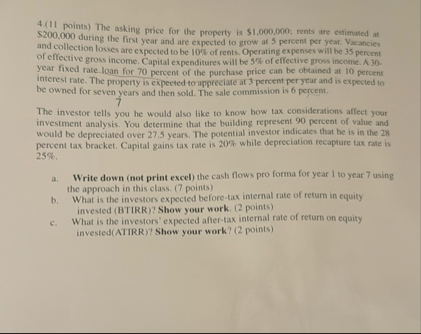

Question: 4 . ( 1 1 points ) The asking price for the property is $ 1 . 0 0 0 , 0 0 0 ;

points The asking price for the property is $; rents are estimated at $ during the first year and are expected to grow at percent per year. Vacancies and collection losses are expected to be of rents. Operating expenses will he peroent of effective gross income. Capital expenditures will be of effective gross income. A year fixed rate loan for percent of the purchase price can be obtained at percent interest rate. The property is expeeted to appreciate at pereent per year and is expected to be owned for seven years and then sold. The sale commission is percent.

The investor tells you he would also like to know how tax considerations affect your investment analysis. You determine that the building represent percent of value and would be depreciated over years. The potential investor indicates that be is in the percent tax bracket. Capital gains tax rate is while depreciation recapture tax rate is

a Write down not print excel the cash flows pro forma for year I to year using the approach in this class. points

b What is the investors expected beforelax internal rate of retum in equity invested BTIRR Show your work. points

c What is the investors' expected aftertax internal rate of return on equity investedATIRR Show your work? points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock